In a recent development, renowned crypto trader and analyst Marco Johanning shared exclusive insights on the Hyblock platform in his recent X post, shedding light on the latest trends in cryptocurrency. Johanning’s observations centered around Bitcoin’s performance post the CPI update, specifically focusing on updated Hyblock Heatmaps and Liquidation Levels for BTC, ETH, SOL, OP, LDO and UNFI.

According to the analyst, the dollar chart witnessed significant fluctuations following yesterday’s Consumer Price Index (CPI) release. As a consequence, stock markets experienced a slight dip. However, Bitcoin’s unwavering stability amidst this economic turbulence was the most noteworthy revelation. Remarkably, the interest and trading volume surrounding Bitcoin remained surprisingly subdued.

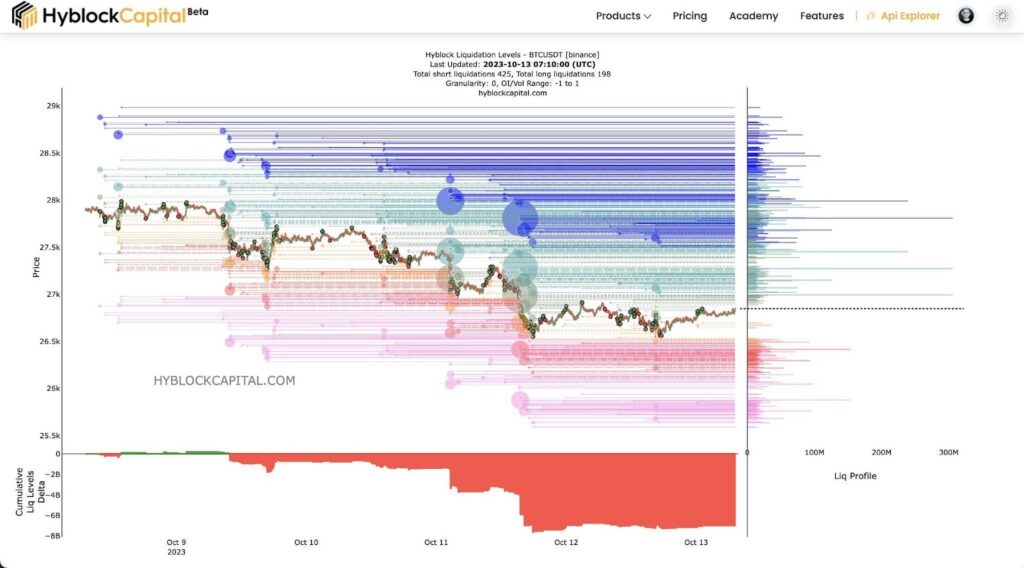

Presently, Bitcoin maintains a stable position at the midpoint of its range, with open interest levels remaining notably high. Johanning emphasized that the exact placement of dividing lines could influence interpretations. According to his analysis, Bitcoin has consistently held a position below the midpoint since Wednesday, with a critical threshold at $26,900 catching his attention.

Johanning delineated two plausible scenarios rooted in his technical assessment. A resurgence in Bitcoin’s value from above the midrange and a surge in trading volume would symbolize a notable display of resilience. Additionally, he brought attention to compelling findings gleaned from an in-depth examination of liquidation levels, pinpointing pivotal focus areas.

However, the analyst also warned of a downside scenario. In the event of rejection and subsequent downward movement, Johanning expressed his intent to explore shorting opportunities. Of paramount importance is the line at $25,965. Should Bitcoin breach this level, it would signify a rupture in the pattern of higher highs and higher lows, potentially heralding the onset of a substantial liquidation event.

Johanning concluded with a cautionary prediction. If Bitcoin descends below $25,965, a shift in market dynamics could lead to a cascade of liquidations, potentially driving the price down to at least $25,000. These insights offer a valuable perspective for traders and enthusiasts navigating the complex landscape of cryptocurrency markets in the wake of economic fluctuations.