- Santiment reports a notable 15,411.92 BTC transaction, underscoring significant market activity amid larger historical trades.

- Market trend shifts as Mean Dollar Invested Age decreases, indicating fresh investments and possible onset of a bull run, Santiment notes.

- Ali’s technical analysis suggests potential Bitcoin rise to $71,800 if it maintains the crucial $70,400 support level.

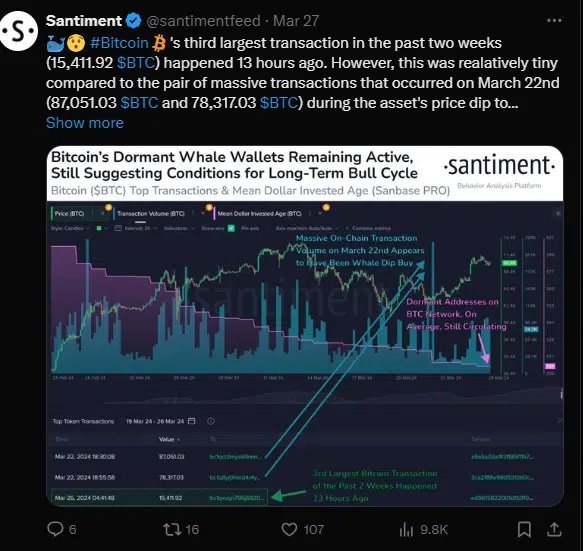

Bitcoin has witnessed significant activity in the past few weeks, drawing attention from investors and analysts. Notably, the third-largest transaction in the recent fortnight involved 15,411.92 BTC, as highlighted by Santiment, a behavioural analytics firm.

This event pales in comparison to the larger transactions on March 22, during a price dip to $63,000. Here, transactions of 87,051.03 BTC and 78,317.03 BTC marked considerable movement. Consequently, on-chain transaction volume soared, hinting at significant buys from key stakeholders.

Moreover, the analysis of these transactions points to a trend of larger wallet accumulations beginning this past weekend. Despite the challenge in pinpointing the exact nature of the wallets involved, patterns suggest a shift towards major stakeholder involvement.

Additionally, the Mean Dollar Invested Age indicator, now highlighted in pink, signals a pivotal market trend as per Santiment data. As this line decreases, it indicates the rejuvenation of investments, with older coins re-entering circulation. Significantly, this movement is often a precursor to bull runs, marking an intriguing phase in cryptocurrency dynamics.

However, as the market observes these developments, BTC’s price remains a focal point. According to the latest data, at the time of publication, the asset stood at $70,311.31, experiencing a minor dip of 0.42% over the last day. Yet, the technical analysis by market experts suggests a promising outlook. Ali, a noted chart analyst, observes a breakout from an ascending triangle on lower timeframes. Hence, if the $70,400 support level holds, Bitcoin could potentially climb towards $71,800.

Besides these analytical observations, the market remains vigilant. The confluence of large-scale transactions, the influx of older coins, and technical chart patterns all contribute to a complex yet fascinating market landscape. Investors and enthusiasts are advised to keep a close eye on these indicators. Moreover, understanding these dynamics could be crucial for navigating the shifting crypto market.