- Bitcoin’s robust support at $37,150-$38,360 is backed by 1.52M addresses, showing strong market confidence despite resistance points.

- Relaxed U.S. crypto regulations and the anticipation of Bitcoin’s halving and ETF approval drive significant market speculation.

- Mixed technical signals with a neutral RSI and declining MACD indicate a complex, uncertain future for Bitcoin’s market trajectory.

In the dynamic world of cryptocurrency, Bitcoin (BTC) remains a topic of keen interest and speculation. Despite its recent price drop to $41,465.96, marking a -1.05% decline over the past 24 hours, the digital currency retains robust support.

As per Ali, a prominent blockchain figure, a solid base exists between $37,150 and $38,360, backed by 1.52 million addresses holding 534,000 BTC. However, Bitcoin faces resistance at $43,850 and $46,400, potentially restraining its upward trajectory.

Several factors contribute to Bitcoin’s fluctuating landscape. The U.S. regulatory environment shows signs of relaxation, hinting at a brighter future for cryptocurrencies. This development casts a positive light on the U.S. Securities and Exchange Commission’s (SEC) dealings with domestic exchanges like Coinbase and Kraken.

The SEC’s ongoing legal challenges with Binance, the world’s largest and most controversial crypto exchange, have also seen developments. Binance agreed to a significant $4.3 billion settlement with U.S. authorities, a decision that may positively influence the broader regulatory landscape.

Anticipated events also influence Bitcoin’s value. The scheduled halving next year, which will reduce the new BTC supply by half, and the potential SEC approval of a Bitcoin ETF application are both key drivers of interest and speculation. These events are particularly significant, with the ETF application considered a primary factor in recent price movements.

Macro-economic indicators also play a pivotal role. Bitcoin, often compared to digital gold, has shown correlations with its tangible counterpart. Gold futures have soared to record highs, driven partly by inflation concerns.

In a similar vein, Bitcoin’s movement aligns with these economic trends. As the Federal Reserve raises interest rates to combat inflation, borrowing costs increase, leading investors to shift away from riskier assets like Bitcoin. Conversely, a potential reduction in rates next year could reinvigorate interest in cryptocurrencies as traditional investments offer lower returns.

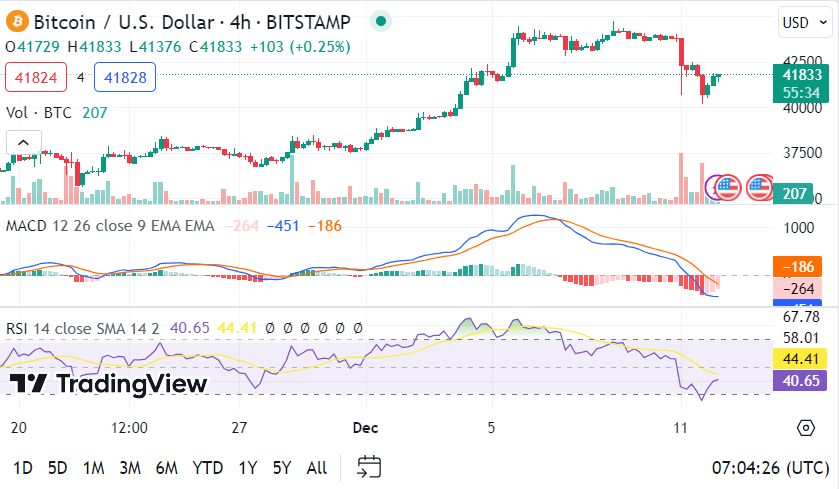

BTC/USD 4-hour price chart, Source: TradingView

With a total circulating supply of 20 million BTC, Bitcoin’s market cap stands at $811billion. Technical analysis reveals mixed signals. The MACD, displayed at the chart’s bottom, trends downwards below the zero line, indicating bearish momentum. Meanwhile, the RSI, around 44.15, suggests a neutral market, neither overbought nor oversold.

The volume, depicted in color-coded bars beneath the candlestick chart, shows stability without notable fluctuations. These technical indicators, combined with broader economic and regulatory factors, paint a complex picture for Bitcoin’s future trajectory.