- Most major cryptocurrencies are currently undervalued, showing potential for short-term price rebounds.

- Dogecoin and Cardano show strong bullish sentiments with significant undervaluation in the current market.

- Santiment’s latest report highlights potential price rebounds for Bitcoin, Ethereum, and XRP in the near term.

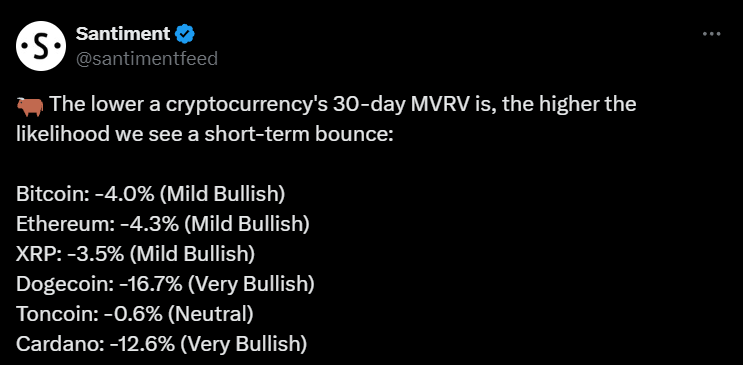

According to a recent Santiment report, the majority of major cryptocurrencies are currently in the undervalued region based on their 30-day MVRV (Market Value to Realized Value) ratios. The data indicates a potential for short-term price rebounds across various digital assets. Santiment, a behavior analysis platform, highlighted this trend in its latest update, pointing to promising investment opportunities for traders.

The 30-day MVRV ratio is a key metric for assessing market sentiment. A Lower MVRV ratio suggests that the asset may be undervalued and could see a short-term price increase. Bitcoin (BTC), Ethereum (ETH), XRP, Dogecoin (DOGE), Toncoin (TON), and Cardano (ADA) were all analyzed, showing varied degrees of bullish sentiment.

At press time, Bitcoin was trading at $65,433.83 with an RSI of 44.91 and a 30-day MVRV ratio of -4.0%, which is considered mildly bullish. This means Bitcoin is slightly undervalued, with a moderate chance of a price increase in the near term.

Contrary Views on Bitcoin’s Correlation With S&P 500Ethereum has an MVRV ratio of -4.3%, also suggesting a mildly bullish outlook and a potential for upward price movement. At press time, Ethereum was trading at $3,559.29 with an RSI of 53.58 and a market cap of $434.54B.

XRP follows a similar trend with a 30-day MVRV ratio of -3.5%. The data suggests that XRP is undervalued to some extent, with a mild bullish sentiment predicting a possible price increase. At press time, XRP is priced at $0.4937 with an RSI of 51.08 and a market cap of $27.35B. These three cryptocurrencies show a clear trend of being slightly undervalued, which presents some fair opportunities for traders to invest.

Dogecoin, priced at $0.126 with an RSI of 40.22, stands out with a significantly more bullish sentiment. Its 30-day MVRV ratio of -16.7% indicates that Dogecoin is highly undervalued. The market sentiment suggests a strong likelihood of a price rebound, making Dogecoin an attractive option for short-term investors. This substantial undervaluation presents a compelling case for potential price surges.

Cardano shows a very bullish sentiment with a 30-day MVRV ratio of -12.6%. This indicates that Cardano is considerably undervalued, suggesting a high likelihood of a price increase. At press time, Cardano was priced at $0.3939 with an RSI of 46.03 and a market cap of $14.17B.

Toncoin displays a neutral sentiment with a 30-day MVRV ratio of -0.6%. This suggests that Toncoin is neither significantly undervalued nor overvalued, indicating a balanced market outlook. Investors might expect stability with minimal price movement in the short term. At press time, Toncoin was trading at $7.10 with an RSI of 33.04 and a market cap of $17.12B.