The price of Bitcoin has soared above $29,000 as quarterly settlement day approaches, and traders continue to flock to the cryptocurrency. This surge in activity has led to short-term implied volatility rising by almost 10% in just one day for the monthly term, indicating a high level of interest and excitement among traders.

Bitcoin, the world’s most popular cryptocurrency, has been experiencing significant fluctuations in price in recent months, with some investors seeing it as a potential hedge against inflation and others concerned about its volatility. However, the latest surge in price has been attributed to the approaching quarterly settlement day, which has led to increased trading activity and a rise in implied volatility.

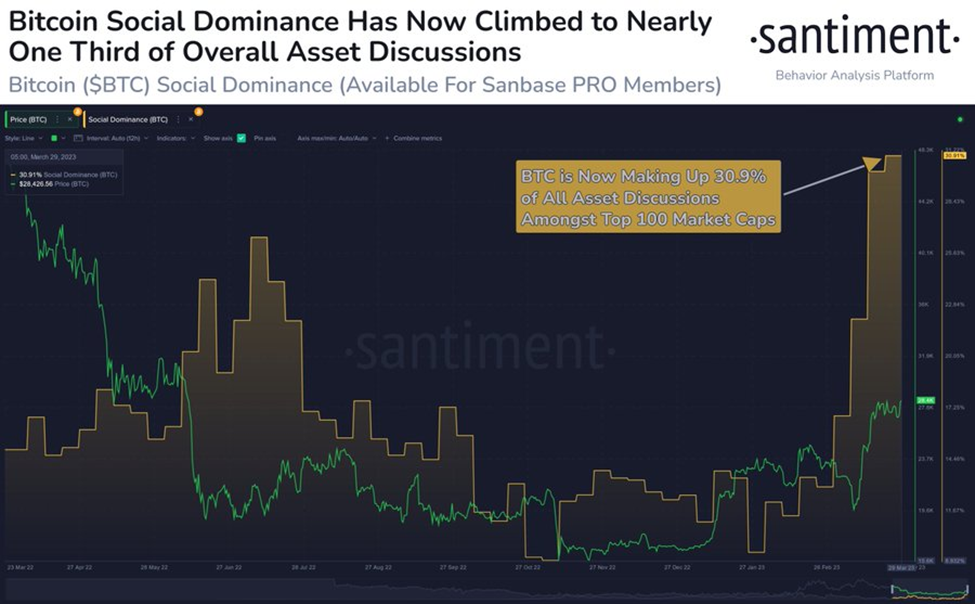

Source: Sanbase

A quarterly settlement day is an important event for Bitcoin traders, as it marks the end of three months and the settling of futures contracts. This period is often marked by increased trading activity, as traders seek to take advantage of price movements and make profits on their investments.

Despite concerns about the volatility of Bitcoin, many investors remain bullish on the cryptocurrency, seeing it as a valuable asset in the digital age. Moreover, with the price of Bitcoin continuing to rise and quarterly settlement day approaching, it is clear that the cryptocurrency market remains a highly dynamic and exciting place for traders and investors alike.

What do technicals suggest about BTC?

According to technical indicators, the outlook for Bitcoin remains bullish, with upside movement imminent. Despite recent fluctuations in price, many analysts believe that the cryptocurrency is poised for further gains soon.

One of the key technical indicators that suggest a bullish outlook for Bitcoin is the Relative Strength Index (RSI). The RSI measures the momentum of price movements and is often used to determine whether an asset is overbought or oversold. Currently, the RSI for Bitcoin is in the mid-50s, indicating that the cryptocurrency is neither overbought nor oversold.

Another technical indicator that suggests a bullish outlook for Bitcoin is the Moving Average Convergence Divergence (MACD) indicator. This indicator measures the relationship between two moving averages and is often used to identify changes in momentum. The MACD for Bitcoin shows a bullish crossover, which suggests upward momentum is building.

Additionally, the Ichimoku Cloud, a technical indicator measuring support and resistance levels, shows a bullish signal for Bitcoin. The cloud has shifted above the current price level, indicating that the cryptocurrency will likely experience further gains soon.

Conclusion

Overall, the technical indicators for Bitcoin are painting a positive picture for the cryptocurrency. While past performance does not indicate future results, many traders and investors remain optimistic about the potential for Bitcoin to continue its upward trajectory in the coming weeks and months.