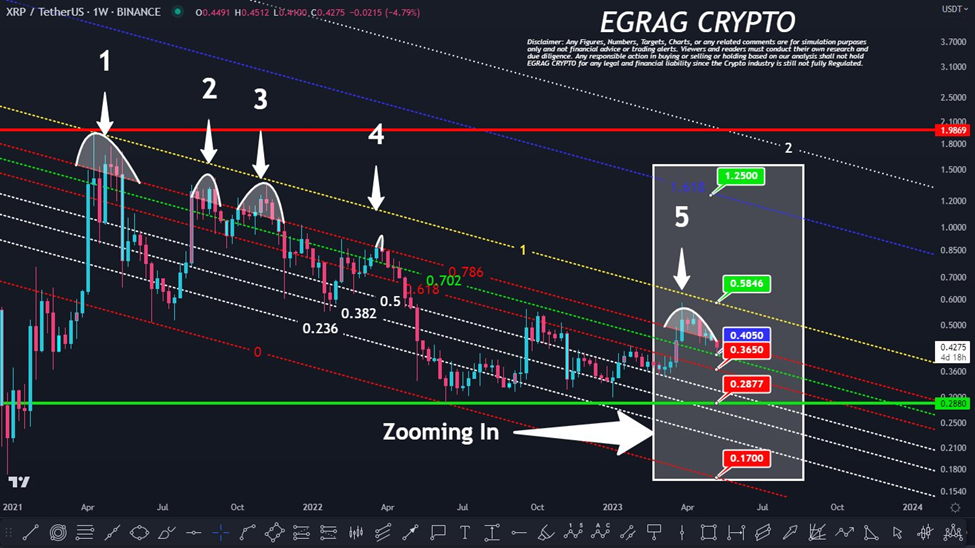

In a recent update posted by Egrag Crypto on Twitter, it was stated that until XRP closes above the Fib Channel 1.0, the cryptocurrency would be ranging, and the Fib Channel 0.786, 0.702, and 0.618 would serve as the ranging pattern. The XRP chart is currently 35% neutral, 40% bullish, and 25% bearish. While it is plausible for XRP to wick to low targets, buyers are advised not to cry and instead buy.

This update follows a tweet posted on April 29th, 2023, which accurately predicted XRP’s key price targets. The tweet also mentioned that XRP attempted to close above the Fib Channel 1.0 on five occasions but failed. Despite this, the post stated that the longer it takes for XRP to establish a solid foundation, the more rigid the foundation will be.

Notably, this XRP analysis has been spot-on with key price targets. Dive into the details and see for yourself:

#XRP Fib Channel – Key Points (UPDATE):

— EGRAG CRYPTO (@egragcrypto) May 10, 2023

The Post dated back on 29th of April 2023, clearly stated the key price targets & #XRP hit these targets exactly as stated. Also, I stated that #XRP did 5 attempts to close above Fib Channel 1.0 but failed.

MOVING ON, WHAT'S NEXT:

1)… https://t.co/RqK3jb5cBa pic.twitter.com/DouxbGVBm1

As we move forward, it’s essential to understand what the future might hold for XRP, especially for investors and traders who closely monitor the cryptocurrency market.

Despite the setbacks, there is no cause for concern on a macro level. XRP’s recent price movements are simply filling the gaps in the charts and retracing, a normal occurrence in cryptocurrencies. Various XRP charts shared by Egragcrypto demonstrate the development of a solid foundation for digital assets.

According to the updated analysis, the Fibonacci Channel levels of 0.786, 0.702, and 0.618 are expected to form the ranging pattern for XRP until it closes above Fib 1.0. Until that point, the cryptocurrency is considered in a ranging phase.

The current state of the XRP chart can be summarized as 35% Neutral, 40% Bullish, and 25% Bearish. Although XRP could wick down to lower targets, investors and traders are advised not to panic but instead seize the opportunity to buy at discounted prices. This strategy aligns with the popular saying in the crypto community, “Buy the dip.”

As the XRPArmy continues to keep a close eye on the progress of its favorite cryptocurrency, it is crucial to stay steady and focused on the long-term potential of XRP. While short-term fluctuations can be nerve-wracking, understanding the broader perspective and maintaining confidence in the asset’s fundamentals can help investors navigate the often unpredictable world of digital currencies.

In conclusion, XRP has achieved its previously stated key price targets. Although it has struggled to close above Fib Channel, a strong foundation is still being built for the cryptocurrency. As the market continues to evolve, it will be vital for traders and investors to remain vigilant, make informed decisions, and capitalize on potential opportunities that arise.