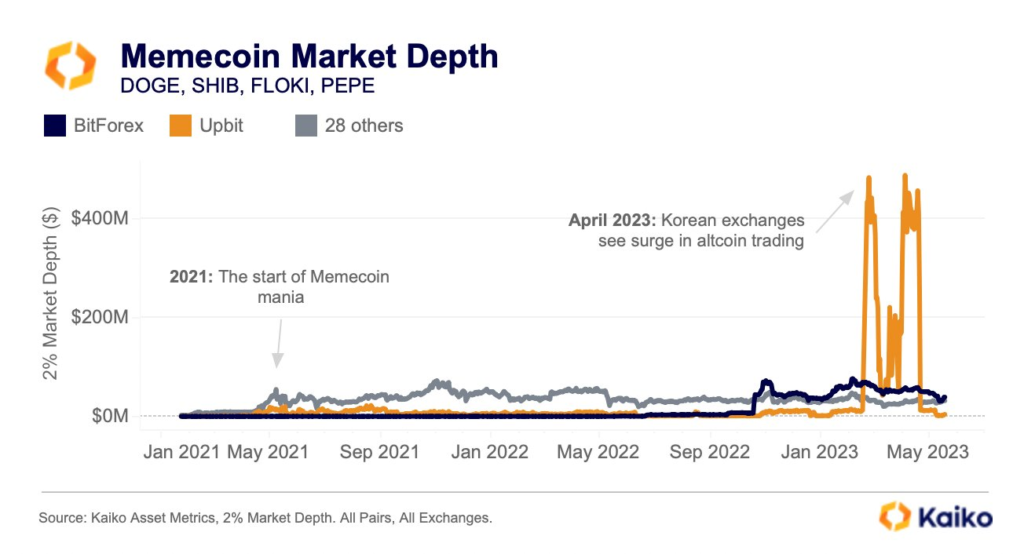

The leading cryptocurrency market data provider Kaiko has shared their latest updates exploring the market making of memecoins. Accordingly, Kaiko explored the 2% market depth for popular memecoins, such as DOGE, SHIB, FLOKI, and PEPE.

Drawing interesting insights, Kaiko took to Twitter to share its findings:

Who is market making the memecoins?

— Kaiko (@KaikoData) May 23, 2023

We charted 2% market depth for #DOGE, #SHIB, #FLOKI, and #PEPE and found:

👉~$55mn has supported memecoin order books since 2021

👉Upbit saw a surge above $400mn from February-April

👉Bitforex is a clear outlier pic.twitter.com/LkLB104OyQ

In a nutshell, the findings shared by Kaiko revealed that the memecoin order books have been supported by $55 million since 2021. The report also highlighted that while South Korea’s largest crypto exchange by trading volume, Upbit, crossed $400 million during the February-April period, the Hong Kong-based Bitforex exchange turned out to be an outlier.

The new Kaiko Asset Metrics data type explains the memecoin market depth of SHIB, DOGE, FLOKI, and PEPE, on BitForex, Upbit, and 28 other exchanges.

The Asset Metrics data type, as per Kaiko, aggregates market depth across all pairs and all exchanges, to present the global amount of capital supporting these markets. It gives asset-level information and liquidity metrics to offer insights into an asset’s market structure. As for the trading activity, the Kaiko Asset Metrics offer details on global volumes for thousands of instruments, whilst also detailing asset supply distribution across a network.

Kaiko’s analysis further stated that the memecoin mania started in April 2021 and peaked in April 2023 (and continued till May 2023) when the altcoin trading on the South Korean crypto exchange Upbit reached above the $400 million market depth level.

An interesting analogy that Kaiko made is that over $55 million in liquidity has consistently supported memecoin order books, with DOGE having a lion’s share. During the same time period, BitForex and 28 other exchanges’ altcoin trading market depth comparatively stood at negligible levels.