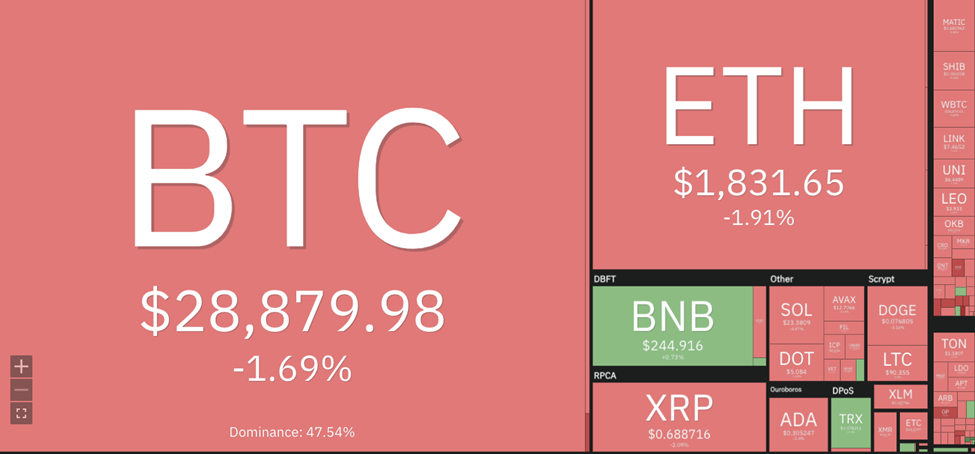

In the fast-paced world of cryptocurrencies, the market overview portrays a dynamic scene with significant volatility as bulls and bears contend for supremacy. The most recent report revealed that BTC is trading just below the $29,000 level after a notable sell-off in the past 24 hours. The leading cryptocurrency struggles at $28,879, experiencing a 1.69% decline in the last 24 hours. Notably, Bitcoin‘s dominance index sits at 47.54%, indicating its influence in overall market sentiment.

CryptoRank, a crypto market data aggregation and analytics platform, shared a tweet providing the current performance of the top coins.

⚡ Market Overview #Bitcoin price trades below $29K

— CryptoRank Platform (@CryptoRank_io) August 1, 2023

The Top-10 are traded in different directions: $BNB +0.62%, $SOL -4.01%, $DOGE -2.66%

Market capitalization: $1.28T (-1.46%)

The #BTC dominance: 43.92% (-0.12%)

Fear & Greed Index: 53 (Neutral) pic.twitter.com/lzs185rXSm

Similarly, ETH undergoes a bearish trend, trading at $1,831, down by 1.91% in the last 24 hours. The break below the critical support level of $1,900 amplifies market pressure and raises concerns regarding potential further losses in the near term. As expected, the broader crypto market experiences the ripple effects of these fluctuations. Among the top-10 cryptocurrencies, SOL is significantly affected, recording a 4.25% decline to $23.44, hinting at the likelihood of further bearish activities.

Conversely, Binance Coin (BNB) emerges as a beacon of resilience amidst the tumultuous crypto market. With a current trading price of $244.73, BNB exhibits a slight but significant 0.62% increase in the last 24 hours. This upward movement starkly contrasts the struggles faced by the meme-inspired Dogecoin. DOGE, which garnered substantial attention and community support, is now grappling with a trading value of $0.0771, reflecting a worrisome 2.66% decrease in the same timeframe.

In the overall picture, the crypto market’s total capitalization stands at $1.28 trillion, down by 1.46% from the previous day. The Bitcoin dominance index also sits at 43.92%, representing a slight 0.12% decrease. The Fear & Greed Index is currently at 53, indicating a neutral sentiment among investors. The remaining altcoins also exhibit divergent directions, with XRP losing 2% and Cardano (ADA) facing a decline of 2.58% in the past 24 hours.

In conclusion, the crypto market showcases bearish and bullish trends, making it a challenging environment for investors. The decline in Bitcoin and Ethereum prices influences the performance of altcoins, leading to mixed results among the top performers and underperformers. With the market sentiment remaining neutral, investors need to assess the ongoing developments and navigate the volatility strategically carefully.