TRON Slashes Network Fees by 60% to Boost Blockchain Use

- TRON has enacted a 60% network fee cut to make transactions cheaper and attract users.

- The network plans quarterly reviews of fees to balance profitability with blockchain use.

- TRON leads in stablecoin transfers and aims to grow adoption with zero-fee transactions.

TRON has announced a sweeping 60% reduction in network fees, marking the most aggressive cut ever. The proposal, submitted by the TRON super representative community on August 26, has been approved and will take effect today. This adjustment positions TRON in closer competition with Ethereum Layer 2 solutions and other low-fee chains such as Solana and Polygon.

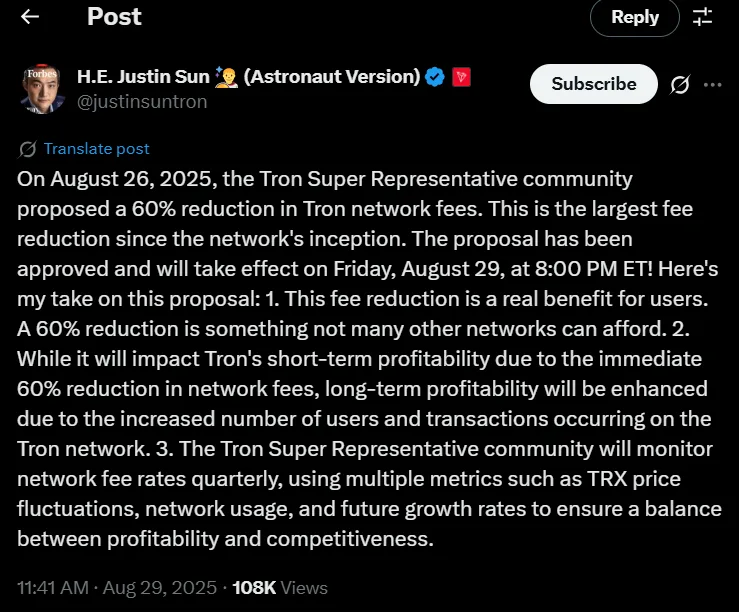

A Landmark Proposal and Justin Sun’s Statement

The proposal to cut the fees is a landmark in the development of TRON. Justin Sun, who published the news on X, announced it as a radical change. He gave three distinct reasons as to why the move was important.

First, he described the change as a tangible benefit for users, noting that a 60% cut is rarely achieved by other blockchain networks. By directly lowering costs, TRON hopes to expand its user base across multiple applications.

Second, Sun acknowledged the financial implications. Short-term profitability for the TRON network will decrease because fees will be directly reduced by 60%. Yet, he explained that long-term gains may be realized since more users and transactions are expected to occur on the network.

Third, he confirmed that TRON’s super representative community will conduct quarterly dynamic monitoring of fee structures. These reviews are expected to assess rates based on TRX price changes, network activity, and growth rates.

TRON’s Stablecoin Dominance and Expanding Role

TRON handles the second-largest amount of stablecoin transactions in the world. Almost 53% of the Tether supply is issued on the network, which underlines the significance of Tether in blockchain-based payments. Having already launched zero-fee transfers of stablecoins, TRON will be able to enhance its attractiveness to retail users and cement its leadership in the industry.

Sun said that the low transaction fees already existing in TRON make it a viable alternative to Ethereum, where transaction costs frequently limit usage. By cutting costs, TRON may attract new players, including both skilled crypto users and beginners.

Related: MetaMask Partners with Tron to Enhance Cross-Chain Ecosystem

Network Model, Risks, and Future Prospects

In contrast to networks that have a fixed gas cost, TRON implements a resource model where a user stakes TRX to receive energy and bandwidth. Energy assists in the execution of the contracts, and bandwidth assists in the throughput of the transactions. This model alone makes TRON a substitute for the conventional blockchain fee systems.

The immediate effect on the revenue is obvious. Reduced charges decrease the revenues generated by the network, which may impair short-term profitability. However, Sun reasoned that growth will be sustained in the long run through increased usage and broader involvement across DeFi, GameFi, and cross-border settlements.

This restructuring of fees builds on previous actions. In early 2025, TRON introduced a feature that reduced weekly transfer fees for USDT by 71%, lowering them to 0.72 TRX from 2.47 TRX. The latest change embeds dynamic governance by committing to quarterly reassessments. These reviews will determine whether adjustments are required to stabilize profitability while maintaining competitive advantages. In a successful case, the strategy can be used as a template that other blockchain networks would follow as they address the trade-off between scalability and profitability.