Bitcoin’s Uptober Rally: Liquidation Zones Tighten as Bulls Hold Momentum

- Bitcoin posts a 10.18% weekly rally, but liquidation heatmap signals rising volatility.

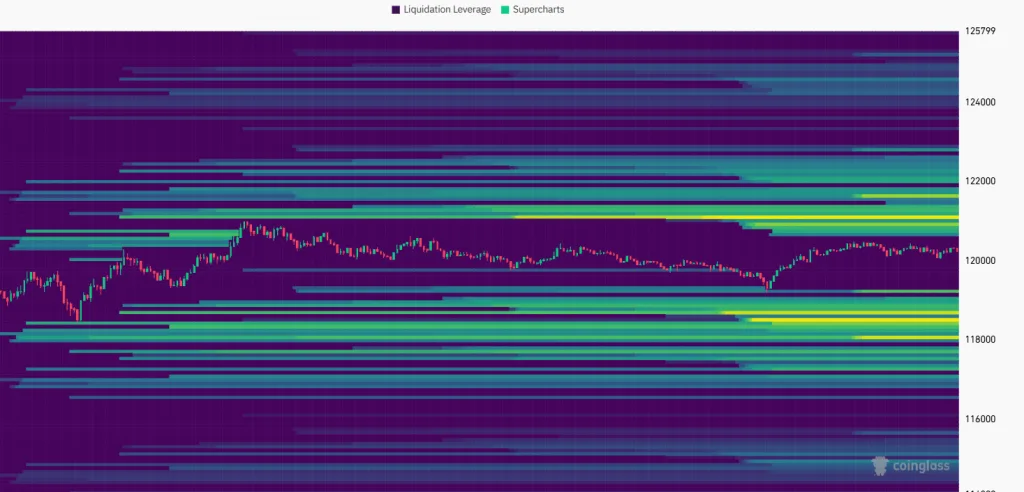

- The Key liquidation risk is set at $121,300, while support bands cluster near $118K–$119K.

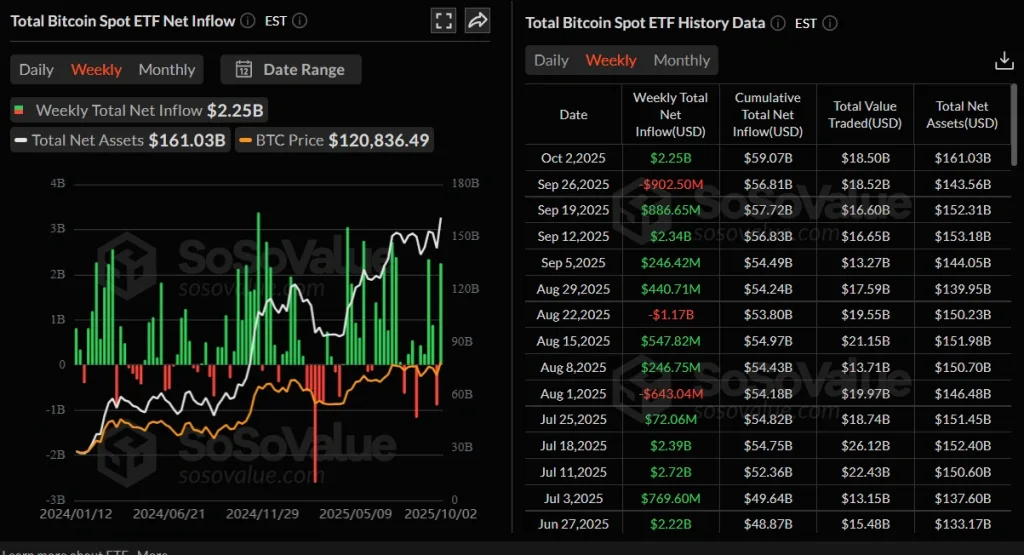

- Spot ETF inflows reach $2.25B, strengthening momentum despite looming resistance.

Bitcoin price is trading near $120,000 on Friday, after a weekly rally of almost 10.18%. The surge came as traders leaned on the “Uptober”, which has historically favored positive returns. Yet, beneath the optimism, signals from liquidation data point toward volatility. Large positions are clustered near key levels, hinting at pressure points that may trigger swift market swings.

The liquidation heatmap showed $121,300 as the level to watch. A shift toward that zone could hasten liquidations and increase volatility. On the downside, liquidity zones around $118,000-119,000 point support, there are a lot of strong buy orders in this zone.

There is also stronger resistance at around $122,000 to $123,000. This zone is attracting sell orders, which are blocking further advancement. A sustained buying pressure would be needed to break through. Otherwise, failure to do so could lead to a pullback towards lesser liquid levels, where buyers may try and defend.

Bitcoin Ends Q3 Steady, Uptober Trends Fuel Optimism

Bitcoin closed September with a 5.16% monthly gain, finishing above $114,000. Across the third quarter, BTC delivered a 6.31% advance, a modest rise that reinforced steady growth. Historical averages for October point to returns of 20.62%.

Quarterly trends also add to the optimism. Data shows the fourth quarter has been Bitcoin’s best, averaging 79.26% gains. If that trend repeats, new highs remain possible before the year’s end. However, traders remain cautious that liquidation risks could disrupt the pattern. Markets are balancing strong seasonal data with immediate technical signals.

Institutional demand supported this week’s price surge. SoSoValue reported $2.25 billion in inflows to Bitcoin spot ETFs as of Thursday. That marked the strongest weekly inflow since mid-September. It also offset the $902.5 million in outflows from the week before. Renewed participation from large investors underpinned Bitcoin’s resilience near $120,000.

Bitcoin Momentum Builds as Indicators Strengthen and Reserves Decline

Technical indicators underline bullish momentum. The MACD line is at 1053, while the signal line is at 198.57, indicating a bullish trend. The histogram turned green and continued to expand. This signals accelerating upside pressure.

Meanwhile, the Relative Strength Index stood at 65.39, showing firm demand just below the overbought threshold of 70. Traders see these levels as confirmation of buying strength, though rapid gains raise the chance of overheating.

Key levels remain the focal point. Support lies near $117,000 to $118,000. Resistance stands at $121,000 to $123,000. Traders see these markers as defining the short-term landscape. A clear breakout could drive the price toward $125,000, while rejection may push it back into prior consolidation zones.

Related: Bitcoin Surges to $119K as Crypto Market Value Hits $4.3T

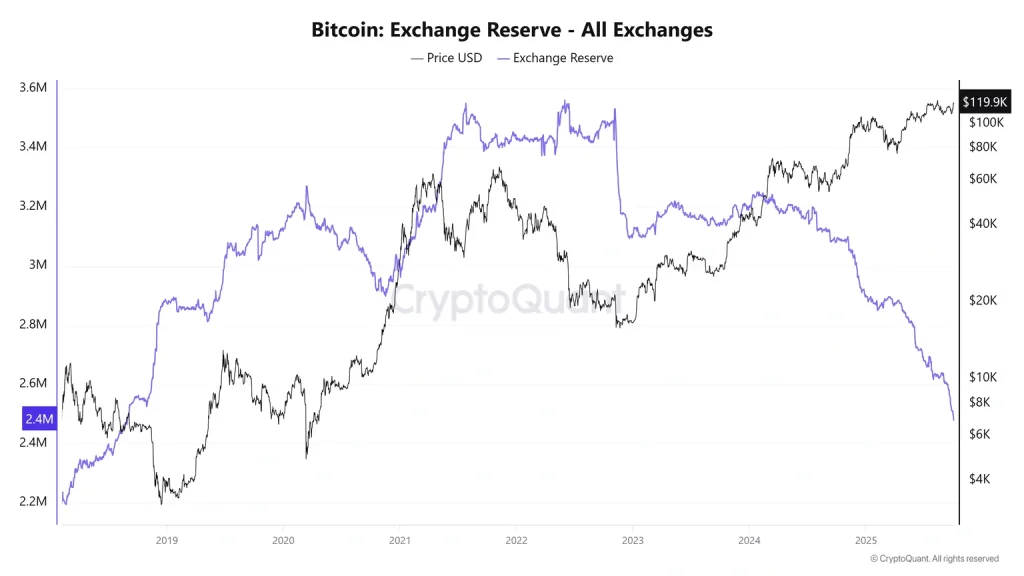

The exchange reserve results also eased selling pressure. According to on-chain data provider CryptoQuant, reserves stood at 2.4 million, the lowest since 2018. The drop also suggests less of the coin is on exchanges and is indicative of continued scarcity. This scarcity has often overlapped with bullish periods, adding a little weight to the current rally.

Macro conditions may also lend support. CME Group’s FedWatch tool showed traders pricing a 97.8% chance of a 25 basis point cut by the Federal Reserve on October 29. A rate cut could ease liquidity conditions and extend support to risk assets. For Bitcoin, it could add momentum, though liquidation clusters remain the immediate test.

The rally of Bitcoin seems to be supported by seasonal trends and massive inflows into ETFs. Liquidation zones continue to serve as near-term volatility triggers despite strong buying interest. With exchange reserves declining and more potential Fed easing coming, the next few weeks will tell whether momentum carries through to the end of the year.