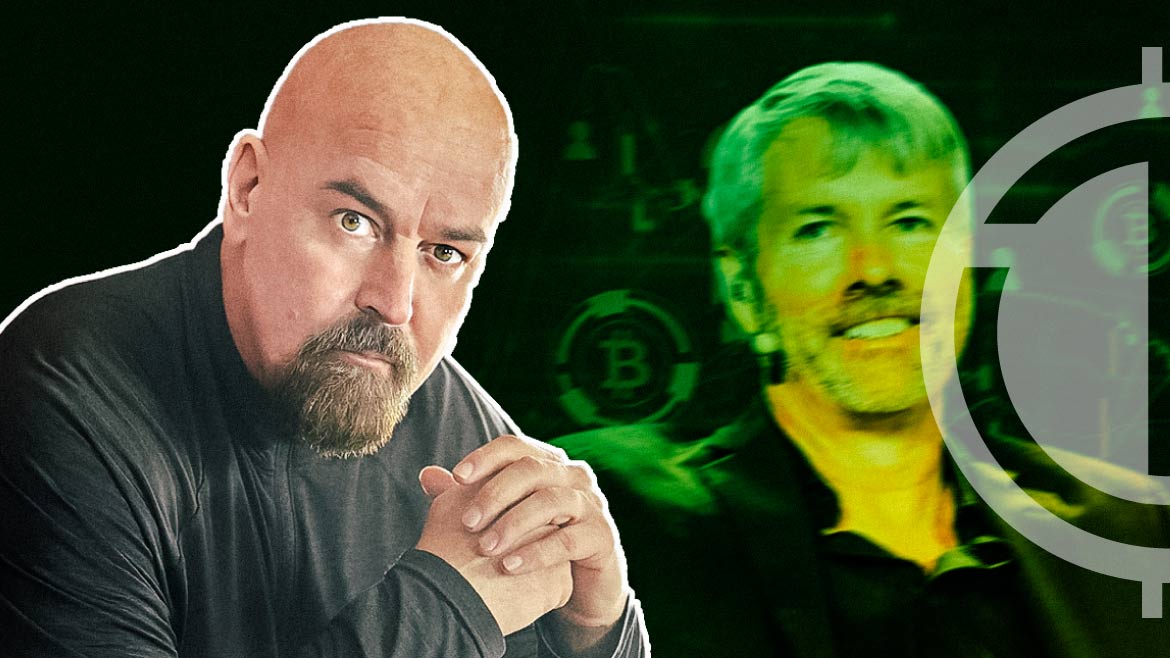

Cryptocurrency advocate John E. Deaton has taken to social media to endorse MicroStrategy CEO Michael Saylor’s recent remarks on Bitcoin. Deaton’s tweet, which followed a segment of Saylor’s interview on Fox Business, underscored the simplicity and strength of the argument for Bitcoin’s bullish prospects. Deaton specifically cited the forthcoming Bitcoin halving event, which will cut the new supply of Bitcoin in half, and the expected introduction of Bitcoin Spot Exchange-Traded Funds (ETFs) as catalysts that could potentially double the demand for the digital currency.

Great clip with the best in the business @cvpayne. I think Saylor points out the best and most simple bull argument for #Bitcoin today. The supply will be soon be cut in half with the #BTC halving coupled with the demand doubling with #BTC Spot ETFs.

— John E Deaton (@JohnEDeaton1) November 6, 2023

When BlackRock and all the… https://t.co/MeMCi6qaXw

Deaton’s commentary extended to the potential ripple effects within the financial sector. He hypothesized that the entry of major financial players such as BlackRock into the Bitcoin market could significantly boost daily demand. He questioned how financial advisors and money managers could ignore Bitcoin’s presence in the market, especially when the halving and Spot ETFs come into play. Deaton suggested that current Bitcoin investors might deepen their commitments while those on the sidelines could be persuaded to allocate a modest percentage to their investment portfolios.

In his interview, Saylor advocated for a radical shift in corporate financial strategy, urging companies to move away from traditional practices and embrace Bitcoin to protect and grow their capital. Saylor’s vision positions Bitcoin as a critical asset for companies to counteract economic challenges such as inflation, potentially offering a more substantial return to shareholders.

Saylor’s strategy at MicroStrategy has been to integrate Bitcoin into the company’s financial framework, a move that has been central to its operations for the past three years. He underscored the success of this approach with MicroStrategy’s stock (MSTR) performance, which has seen a remarkable 213% increase year to date.

This impressive growth has outperformed the ‘Magnificent Seven’—major companies such as Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla—that have collectively propelled the S&P 500’s nearly 13% increase this year. Notably, among these industry giants, only Tesla has incorporated Bitcoin into its balance sheet, mirroring the kind of strategy Saylor champions.

Saylor also shared an asset class total returns chart, which demonstrated Bitcoin’s staggering 1,120,785% return from 2011 to 2023, an annualized return of 147.5%. He suggested that the strategic implications for businesses worldwide are profound, with Bitcoin offering a viable alternative to conventional corporate strategies that are increasingly challenged by the current economic climate.