In a startling revelation from the esteemed on-chain analytical platform, Spot On Chain, a colossal whale, has made waves in the cryptocurrency sphere by pouring a staggering $48 million into purchasing 21,192 Ethereum tokens. In a recent X post, Platform revealed that this substantial investment was executed at an average price of $2,265, marking a significant move in the market.

This marks a recurrent instance where the mysterious whale has caused significant ripples related to digital assets. Commencing on January 13, 2023, this elusive participant has discreetly gathered an impressive 79,500 ETH from decentralized exchanges (DEX) and Binance, leveraging an average procurement cost of $1,790. Surprisingly, these calculated acquisitions have resulted in an unrealized profit totaling $36.84 million, showcasing an extraordinary surge of 25.9%.

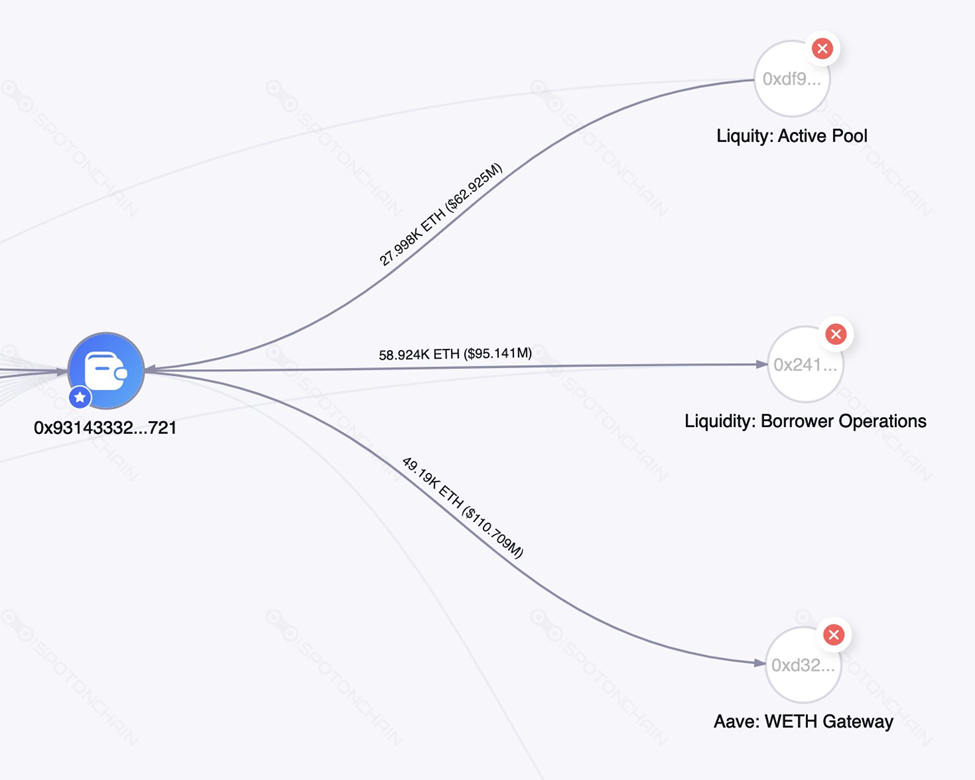

The financing strategy behind these monumental acquisitions has become a focal point for industry experts’ scrutiny and analysis. Recent revelations have exposed that these acquisitions were primarily facilitated via leveraging revolving loans obtained from prominent platforms like Aave and Liquidity. This unveiled the sophisticated financial maneuvers and strategic leveraging tactics the whale employs, garnering substantial attention within the crypto realm for its financial acumen and strategic positioning.

Moreover, the information suggests that the whale is optimistic about Ethereum. These substantial purchases indicate a significant investment and a deliberate and calculated long-term stance on the digital asset. This strongly suggests the whale’s bullish sentiment towards Ethereum’s future prospects and growth potential.

This revelation has set tongues wagging within the cryptocurrency community, sparking debates and speculation regarding the implications of such a significant investment in Ethereum. Market observers and enthusiasts are closely monitoring the ensuing ripples within the crypto markets, speculating on the potential impact of this whale’s hefty acquisitions on the overall trajectory of Ethereum and the broader digital asset landscape.

The evolving nature of the crypto sphere, witnessing these mammoth transactions, holds the attention of investors, analysts, and enthusiasts. This underscores the increasing significance of on-chain analytics in deciphering the intricate dynamics of the crypto market.