The 21Shares Ripple XRP Exchange-Traded Product (ETP) stands out with its impressive performance. Launched in April 2019, the ETP has seen a significant increase in its Net Asset Value (NAV) and has consistently outperformed major indexes like the S&P 500 and the Euro Stoxx.

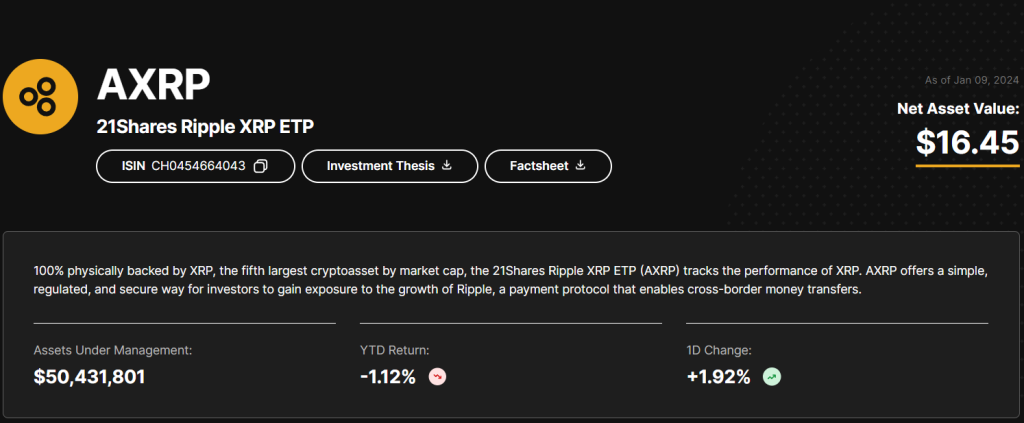

The 21Shares XRP ETP, also known as AXRP, has witnessed remarkable growth since its inception. With its NAV currently at $16.45, the ETP’s assets under management (AUM) have reached a notable $50.4 million. This growth is attributed to strong investor confidence and the ETP’s ability to mirror the performance of XRP, the sixth-largest cryptocurrency by market capitalization.

Recently, there was a misconception regarding the ETP’s association with Fidelity Investments. However, it was clarified that the ETP listed on Fidelity’s platform is the 21Shares Ripple XRP ETP, not a product launched by Fidelity. This clarification is crucial in understanding the ETP’s standalone performance and its direct correlation with XRP.

The 21Shares XRP ETP’s performance is further illuminated by its key metrics. Currently, the ETP holds 3,065,000 outstanding securities, a metric that indicates the total number of shares available in the market. The ETP’s AUM is influenced by XRP’s price movements and activities of authorized participants who can create or redeem shares. On its hand, XRP recently traded at $0.6164, over 10% increase in the past 24 hours.

In other reports, David Schwartz, Ripple’s CTO, expressed doubts about the company’s decision to lock 55 billion XRP in escrow in 2017. This decision, aimed at managing XRP’s supply in the market, has sparked discussions within the XRP community about Ripple’s strategy and the escrow’s impact on the cryptocurrency’s value.

As the 21Shares XRP ETP continues to attract investor attention, it also raises questions about the future of cryptocurrency-based investment products in regulated markets. The ETP’s performance and the ongoing discussions around Ripple’s escrow strategy indicate a maturing cryptocurrency market that combines innovative investment products with traditional financial principles.