In a recent development, renowned crypto analyst Colin Wu, through Wu Blockchain X post, has shed light on the surge in digital asset investment products following the debut of the Bitcoin spot ETF. The past week witnessed an impressive influx of $1.18 billion, subject to T+2 settlement.

According to a recent report, the crypto market experienced a whirlwind, with trading volumes skyrocketing to a staggering $17.5 billion. This figure smashes previous records and starkly contrasts the average weekly trading volume of $2 billion observed throughout 2022. Notably, these volumes constituted almost 90% of the daily trading activities on reputable exchanges last Friday, showcasing an unprecedented spike compared to the usual 2%-10% range.

While the recent inflows were substantial, they fell short of the record set during the launch of futures-based Bitcoin ETFs in October 2021, which amassed $1.5 billion. However, Exchange-Traded Product (ETP) trading volumes hit an all-time high, painting a bullish picture for the digital asset market.

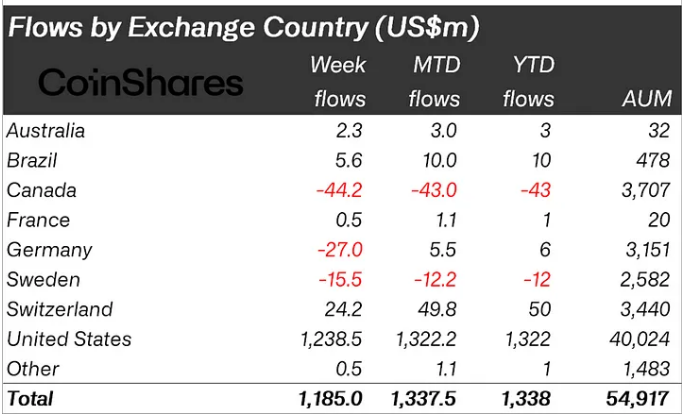

The United States emerged as the dominant force, witnessing a colossal $1.24 billion inflows. Simultaneously, Switzerland secured $21 million in investments. A noteworthy trend unfolded in Europe and Canada, where outflows were detected, totaling $44 million in Canada, $27 million in Germany, and $16 million in Sweden. Analysts speculate these outflows might be attributed to basis traders realigning their positions from Europe to the United States.

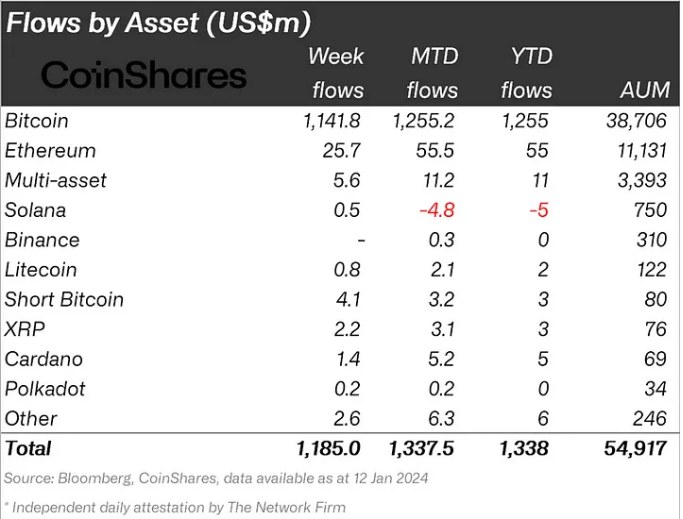

Bitcoin stole the show with $1.16 billion in inflows, constituting 3% of the total assets under management (AuM). Surprisingly, short-Bitcoin also experienced a minor uptick, with inflows totaling $4.1 million.

Other leading cryptocurrencies also made their mark, with Ethereum attracting $26 million in inflows and XRP securing $2.2 million. However, Solana deviated from the trend, registering only $0.5 million in weekly inflows.

In a parallel development, blockchain equities witnessed a substantial uptick, accumulating inflows totaling $98 million. This surge adds to the momentum of the past seven weeks, bringing the cumulative inflows to an impressive $608 million. The data from CoinShares underscores the resilience and burgeoning interest in the digital asset market, hinting at a promising trajectory for the foreseeable future.