The virtual asset space is witnessing a unique shift, particularly in the Lido DAO (LDO) market. On-chain data, from Santiment, suggests a notable trend in whale behavior for LDO. This analysis delves into the intricate movements of LDO’s price, supply, and trading volumes, offering an insightful perspective on the current market scenario.

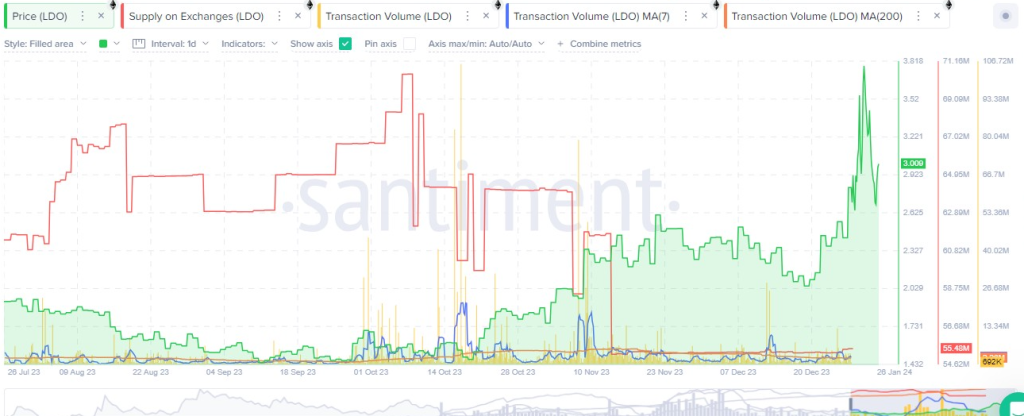

Whales have been consistently taking profits in LDO since December 25, 2023. This pattern emerges from whale transactions, each exceeding $100,000 in value resulting in a noticeable surge in the Network Realized Profit/Loss metric. Moreover, LDO’s supply on exchanges saw an increase from 5.09% to 5.69% from January 9. Typically, a rise in supply on exchanges signals a potential selling pressure, yet the market shows resilience.

Transaction volumes in LDO have also seen significant fluctuations. The most recent days marked a spike in transaction volume, indicating heightened market activity. The moving averages of transaction volume reveal a more nuanced picture. While the longer-term trend (200-day moving average) remains stable, the short-term (7-day moving average) shows volatility, reflecting immediate market reactions.

Additionally, daily price chart analysis from TradingView offers valuable insights. The chart, consisting of candlesticks, shows a mix of bullish and bearish signals. The closing price of approximately $2.982, coupled with a recent low trading volume, paints a complex picture of market sentiment. The Exponential Moving Average (EMA) suggests a slight uptrend, with the last price hovering just above the EMA line.

The Relative Strength Index (RSI), a momentum indicator, stands at a neutral 50.08. This midpoint suggests a balanced market, with no clear signs of overbuying or overselling. The market, in recent days, has shown volatility but appears to be stabilizing with a slight upward trend.

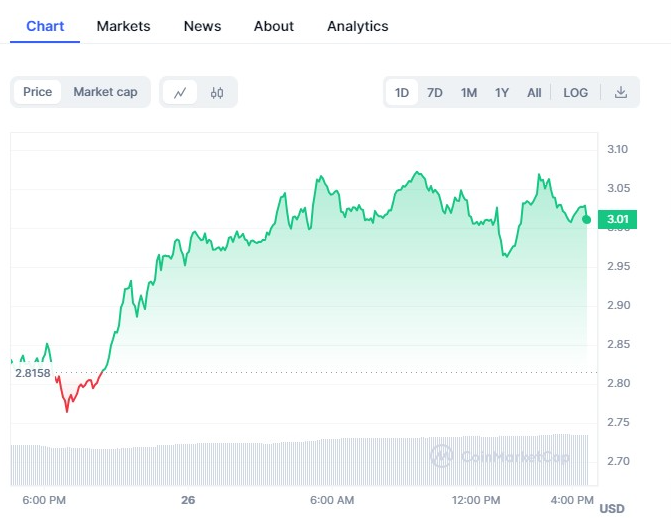

Furthermore, per data from CoinMarketCap, Lido DAO is experiencing a positive shift, up by 6.51% to $3.02 in the last 24 hours. This uptick adds another layer to the market’s current state, indicating investor confidence amidst the observed whale activities.

Significantly, recent activity from notable investors underscores this trend. A prominent whale, as reported by Scopescan, withdrew 361K LDO and accumulated over 1 million LDO in the past week. Such activities suggest a strategic approach to market movements, where savvy investors capitalize on dips.

The Lido DAO market is navigating through a phase of profit-taking by whales, coupled with a stable yet vigilant trading environment. This blend of whale activities and market resilience makes the LDO market a fascinating study in current cryptocurrency trends.