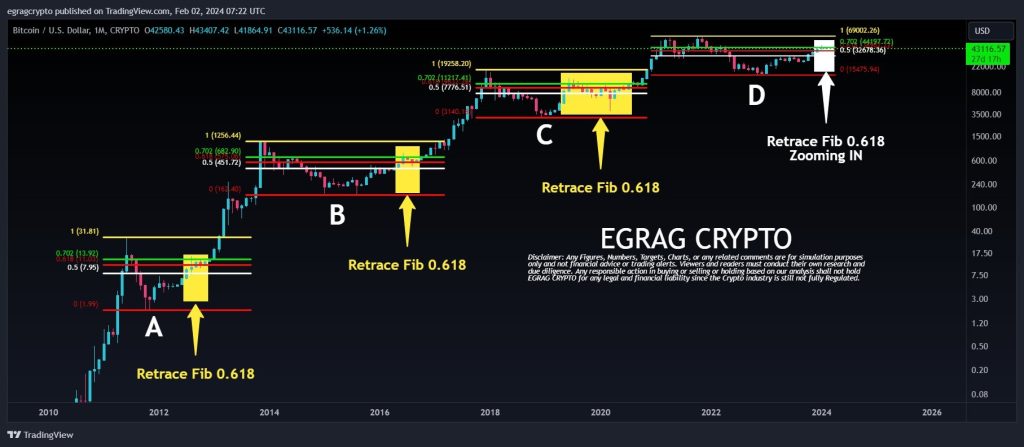

In a recent revelation by the renowned crypto analyst Egrag Crypto, the spotlight is on Bitcoin as it grapples with a critical juncture indicated by the Fibonacci (Fib) 0.618 touch down. In a recent X post, the analyst delved into a comprehensive chart analysis, hinting at potential scenarios poised to unfold upon the next encounter with this crucial Fibonacci level.

Egrag suggests that the Fib 0.618 touchdown is a crucial juncture for Bitcoin, indicating the potential divergence of two distinct paths in its immediate trajectory within the crypto realm. Bitcoin could maintain its position above the Fib 0.618 level, fluctuating between 38K and 40K, followed by a rapid descent in a flash crash towards Fib 0.5. Conversely, the alternate scenario presents Bitcoin slipping below the Fib 0.618 level, situated between 36K to 38K, potentially setting the stage for a swift flash crash downwards to Fib 0.5.

Source: Chart by Egrag Crypto

Egrag doesn’t stop at these short-term predictions; he delves into a macro overview, outlining key downside targets that could shape Bitcoin’s trajectory. While unnerving, a weekly breach of 30K is classified as supernormal. Falling below 25K on a weekly basis, although unsettling, is deemed normal. However, descending below 22K is considered abnormal, and dropping below 18K is highly unusual.

The analysis delved deeper into the potential consequences if Bitcoin were to dip below the November 2022 low. According to Egrag, such a move could indicate a more profound journey into completing the C leg, with targets set at 13K, 10K, 7K, and even 3.6K, while still maintaining a Macro Secular Up Trend. It is important to note that Egrag refrains from outrightly predicting these targets and emphasizes the need to keep an open mind.

Source: Chart by Egrag Crypto

Positioned in the 80K-100K range, Egrag Crypto envisions a retracement to 30K as part of a cyclical bottom, injecting a layer of complexity into Bitcoin’s already intricate journey. As the crypto community grapples with these insights, the overarching theme remains uncertain, with traders and enthusiasts keenly observing the intricate dance between Fibonacci levels and potential future scenarios for Bitcoin.

In the ever-shifting currents of the cryptocurrency market, Egrag’s analysis injects depth into the unfolding saga of Bitcoin’s price dynamics. This keeps the crypto community on the edge of anticipation, attentively watching the charts for the next twist in this captivating narrative.