Artificial intelligence (AI) integration has become a focal point, with countries worldwide showcasing varying levels of interest and engagement. Rewnowend analytical platform CoinGecko has revealed the latest data from 2024 highlighting the top AI crypto countries, with the United States emerging as the dominant player, followed by notable contenders such as the UK and Turkiye.

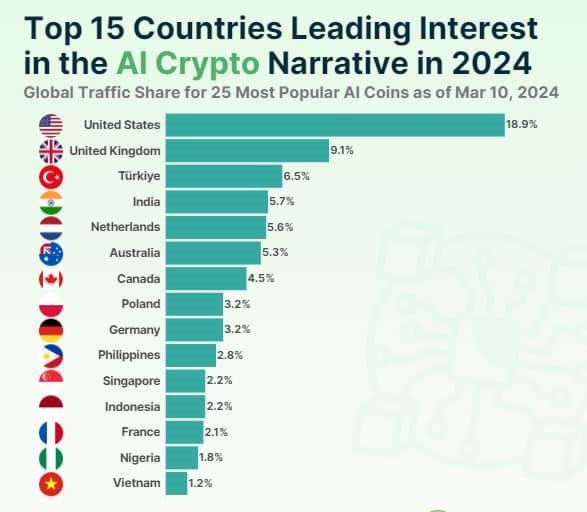

According to a recent report, the US accounted for a significant 18.9% share of global interest in AI crypto narratives, solidifying its position as a frontrunner. Following closely behind, the UK secured a 9.1% share, while Turkiye captured 6.5%, underscoring a diverse geographical spread of interest in AI-infused cryptocurrencies.

Source: CoinGecko

Beyond these leading nations, five other countries emerged prominently in global rankings for AI crypto and meme coins, including India, Australia, Canada, and the Philippines. This trend suggests a heightened responsiveness to market narratives within these regions, reflecting the evolving dynamics of the crypto landscape.

Notably, Southeast Asia exhibited a notable surge in interest in AI crypto coins, with four countries securing positions among the top 15 globally. The Philippines, Singapore, Indonesia, and Vietnam showcased substantial interest shares, further diversifying the geographical distribution of AI crypto enthusiasts. The top 15 AI crypto countries command a majority market share of 74.4%, indicating the concentrated interest and influence exerted by these nations in shaping AI-driven crypto trends worldwide.

In the AI cryptocurrency scene of 2024, Bittensor (TAO) emerged as the dominant player, capturing 11.95% of total market interest. Render (RNDR) followed closely behind with a 10.18% share and Fetch.ai (FET) with 8.86%.

At the time of reporting, RNDR held the top spot in terms of AI altcoin market capitalization, as per CoinGecko data. Its price surged over twofold to $11.44 since the beginning of the year, mirroring a similar rise in TAO during the same period.

RNDR’s Relative Strength Index (RSI) recently dipped below the overbought threshold, indicating a corrective phase. However, overall sentiment remained bullish, with RSI above the neutral 50 mark. Contrarily, TAO’s RSI hovered above the neutral mark. A drop below it could reinforce bearish sentiments.

Source: TradingView

Despite the speculative allure of AI-related cryptocurrencies, not all coins with such associations received equal attention. Nonetheless, the evolving landscape underscores the growing intersection between AI and cryptocurrency, with global trends reflecting a complex interplay of geographical preferences, market narratives, and technological innovation.