According to data from DeFiLlama, there is a significant shift in the Total Value Locked (TVL) standings between two major players in the decentralized finance (DeFi) ecosystem: Base and Polygon. Base has recently overtaken Polygon, ascending to the 8th position with a TVL reaching $1.099 billion, while Polygon’s TVL stands close at $1.091 billion.

In terms of infrastructure, Base supports 239 protocols, a figure that is less than half of Polygon’s 541 protocols. However, Base has witnessed a remarkable uptick in TVL growth. Over a single day, Base’s TVL rose by 3.64%, while Polygon saw a 0.56% increase.

The weekly and monthly changes accentuate Base’s accelerated growth, with 40.94% weekly and 163% monthly increases, compared to Polygon’s 7.64% and 7.74% over the same periods, respectively.

Despite a smaller number of protocols and fewer addresses 268,045 for Base compared to Polygon’s 992,121, the aggressive growth in Base’s TVL suggests a surging interest and an influx of large capital into its DeFi space. This reflects investors’ confidence due to recent developments that Base has secured.

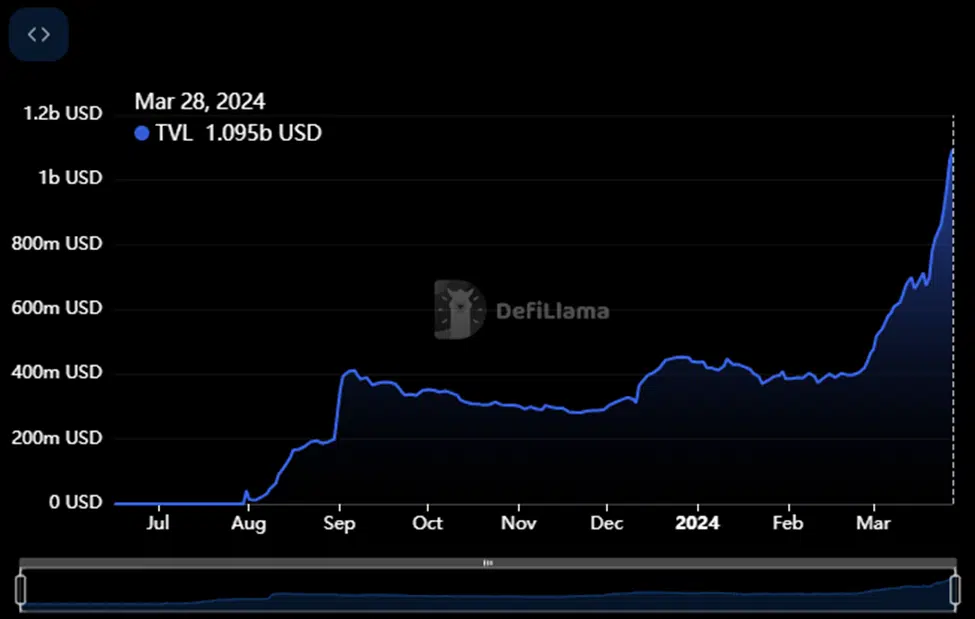

In addition, data from DeFiLlama shows that Base TVL displays a significant upward trend, with a steep rise to a new high observed this March. The TVL measures the total capital held in the smart contracts of DeFi platforms, which often include lending protocols, decentralized exchanges, and other financial services on blockchain networks.

At present, Base TVL is noted to be approximately $1.095 billion. This value suggests a substantial amount of assets are currently being staked, lent, or deposited across various DeFi applications. The sharp increase in TVL indicates growing investor confidence in DeFi platforms, an influx of new projects increasing the capacity for value, or significant recent investments into the space.

Looking at Polygon’s native token performance, MATIC is exhibiting a bearish market as the coin struggles to hover above $1. MATIC has been trending in the negative territory in most of today’s session as the bearish activity takes hold. The market capitalization and the trading volume are on the decline, with their values at $10 billion and $430 million, respectively. This suggests the increasing selling pressure in the Polygon market.

At press time, Base is exchanging hands at $0.00000454, with a massive decrease of 13% in the past 24 hours. Base has been trading on a descending channel over the past month as $0.000023 to $0.0000045, a decrease of over 20%. The trading volume has dropped to $660,407, a decline of 17%, suggesting a strong bearish trend.

Avalanche has been sparking market interest recently, recording a monthly increase of 37%, rallying from $17 to climb above the $60 level and marking a new yearly high. AVAX is trading at $54.48 with a daily gain of 1.68%. However, optimism is trading on a downward trajectory today despite exhibiting a steady uptrend over the week to reach the $4 mark. As of this writing, OP is exchanging hands at $3.70 with a decrease of 1.91% on the daily timeframe.