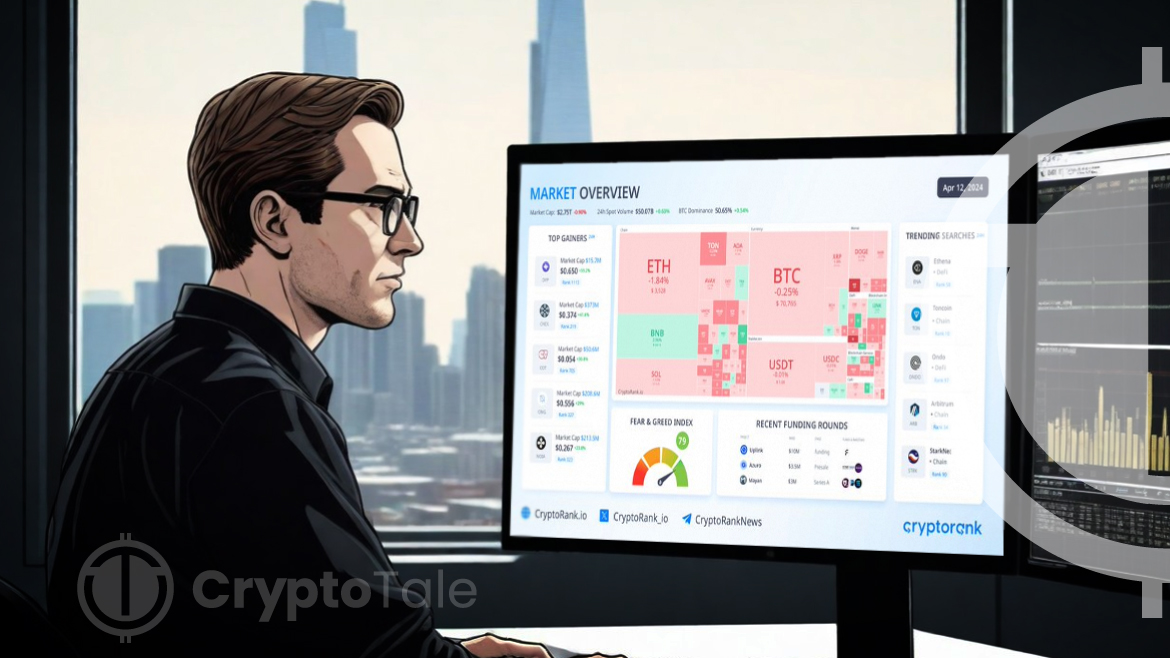

In the latest developments within the cryptocurrency market, Bitcoin continues to assert its dominance despite a slight decrease in overall market capitalization, per CryptoRank analysis. At press time, Bitcoin trades just below the $71,000 mark, with its market dominance increasing by 0.54% to 50.65%. This growth comes amidst mixed performances among the top 10 cryptocurrencies, signaling a varied investor sentiment across the board.

The cryptocurrency landscape saw divergent trends among major players. Binance Coin (BNB) experienced a positive adjustment with an increase of 2.73%, contrasting sharply with Solana (SOL) which dipped by 1.16%. The token TOM faced a significant setback, dropping by 5.39%. These fluctuations underscore the unpredictable nature of cryptocurrency investments and highlight the disparities in performance among top-tier digital assets.

The total market capitalization of cryptocurrencies has witnessed a modest decline, falling by 0.90% to $2.75 trillion. This slight downturn reflects broader market uncertainties but hasn’t significantly dampened the overall market dynamics. Meanwhile, the Crypto Fear & Greed Index points to ‘Extreme Greed’ with a score of 79, indicating a strong investor appetite for risk despite the market’s fluctuations.

Amidst the general market’s mixed results, some cryptocurrencies have made significant strides. Dypius (DYP) leads the pack with a remarkable surge of 59.2%, followed by Chintai (CHEX) which climbed 41.4%. The Cosplay Token (COT) also made notable gains, increasing by 30.4%. These movements reflect specific market niches that continue to attract intense investor interest, possibly due to unique underlying fundamentals or the recent positive developments associated with their projects.

The dynamic shifts in cryptocurrency valuations and the significant gains by certain tokens continue to attract both seasoned and new investors, keeping the market lively and unpredictable. As Bitcoin’s influence grows, the broader market’s response remains a key area of interest for stakeholders.

In other related reports that could cause ripples in the crypto market, Hong Kong is poised to approve exchange-traded funds (ETFs) that will invest directly in Bitcoin and Ether, the two leading cryptocurrencies, potentially as early as Monday, per a Bloomberg report. An international division of Chinese asset manager Harvest Fund Management Co., along with a collaborative effort between Bosera Asset Management (International) Co. and HashKey Capital, are anticipated to receive authorization for these spot-crypto ETFs, said the sources, who preferred to remain anonymous as the details have not been made public.