According to recent data released by Glassnode on X, Rune transactions have experienced a significant revenue shift following the Bitcoin halving event. On the day of the halving, these transactions gathered an impressive $62.4M in fees. However, current revenue from Rune transactions has drastically reduced to $1.03M.

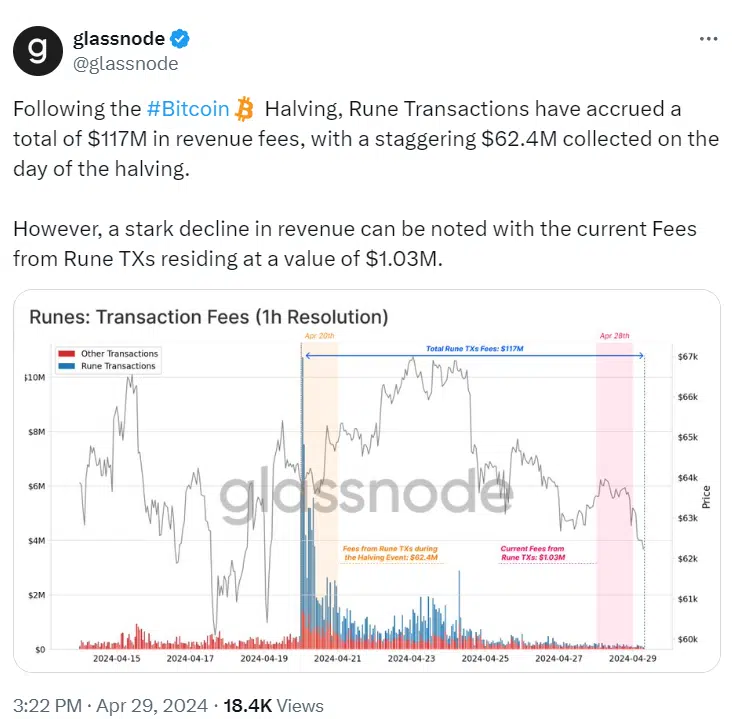

This financial trajectory was captured in a detailed chart by Glassnode, tracking the fluctuations of transaction fees at an hourly resolution. It features dual Y-axes, with the left showing fees in USD and the right displaying the cryptocurrency’s price in BTC. This setup helps assess the relationship between transaction costs and the cryptocurrency’s market price.

Significantly, the graph includes a shaded section on April 20, marking the halving event with a peak in Rune transaction fees amounting to $6.2M. The halving typically reduces the supply of new coins, sparking a temporary surge in transaction fees due to heightened network activity.

Moreover, the graph reveals a correlation between fees and price decreases post-halving. Both the fees and the price in BTC saw a decline, suggesting that the halving’s impact was only short-lived. Despite this, the network fees have stabilized at levels slightly above those seen before the event, indicating a new baseline for transaction costs.

The chart also differentiates transaction types through color-coding—blue bars represent Rune transactions, while red bars denote other transaction types. This visual differentiation aids in quickly identifying revenue streams within the network.

Additionally, analysts observing the market behavior post-halving would note the initial spike in fees as an indicator of increased demand and activity within the network. The subsequent normalization of fees, while higher than pre-event levels, reflects a recalibration of network economics in response to the reduced coin supply.

This data offers crucial insights into the dynamics of transaction fees within the Rune cryptocurrency network, especially in the context of significant market events like a halving. It underscores the nature of crypto fees and their sensitivity to network and market changes.