2022 remains a difficult year for the global crypto market. However, stablecoins were one of the few digital assets that won investors’ trust and love

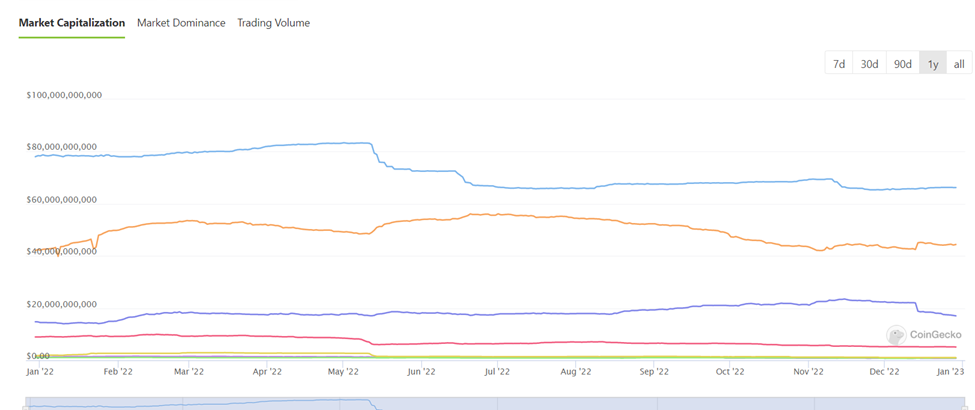

According to CoinGecko, the entire market capitalization of the stablecoin ecosystem remains a little over $28bn.

Lately, more than $3bn worth of value has been wiped out from the stablecoin economy in the last 23 days as BUSD shed roughly 23% in November.

With a market capitalization of $66,247,371,124, Tether remains at the top of the list.

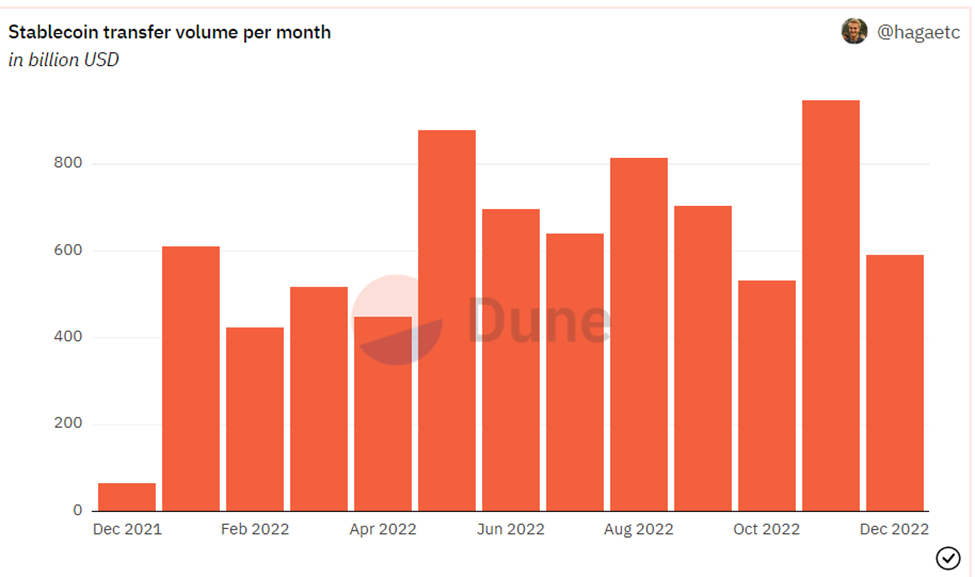

Further, despite a global crypto meltdown, stablecoins have written a different story and set a new record of total volumes this year. The assets executed $7.4T worth of transactions in 2022, a rise of $6T from 2021. Stablecoin volume increased more than 600% in two years signalling the rise of investors faith in the digital assets.

What are stablecoins:

Stablecoins acts as a bridge between traditional financial and blockchain-based crrency that represents the value of a real-world asset. Majority of stablecoins are pegged to the U.S dollar. In the ecosystem,one unit of the cryptocurrency mostly equals of the real currency. As per the Coinmarketcap, top four stablecoins in terms of marketcap are Tether, USD Coin, Binance USD, and Dai.

Types of stablecoins:

- Fiat-collaterlized stablecoins: These cryptocurrency have the backing of a fiat currency mostly USD.

- Commodity-backed stablecoins: These coins posses the backing of interchangeable assets such as precious metal such as gold. E.g Digix Gold or DGX.

- Crypto-backed stablecoins: These stablecoins have the backing of the volatile cryptocurrency. The prominant feature is that crypto-collaterlized stablecoins provide better decentralization as compared to fiat-collateralized stableocins.

- Algorithmic stablecoins: A non-collaterlized of algorithmic stableocins do not have any assets or collateral for backing them. These stablecoins follow an algorithm to take a control the supply of stablecoins.