U.S stocks remain directionless as traders become cautious ahead of major central banks’ decision

Highstreet (HIGHS) price remains bullish for the day. The price zoomed over 20% on the first trading of the last week of the first month of the new year. HIGHs opened the session higher but retreated as the U.S. trading session opened. A significant part of the day market dances to the tune of the various central bank’s expectations set later in the week.

The market is expected to announce a 25bps increase on Wednesday, while on Thursday, the Bank of England (BoE), and the European Central Bank (ECB) is set to raise interest rates by 50bps.

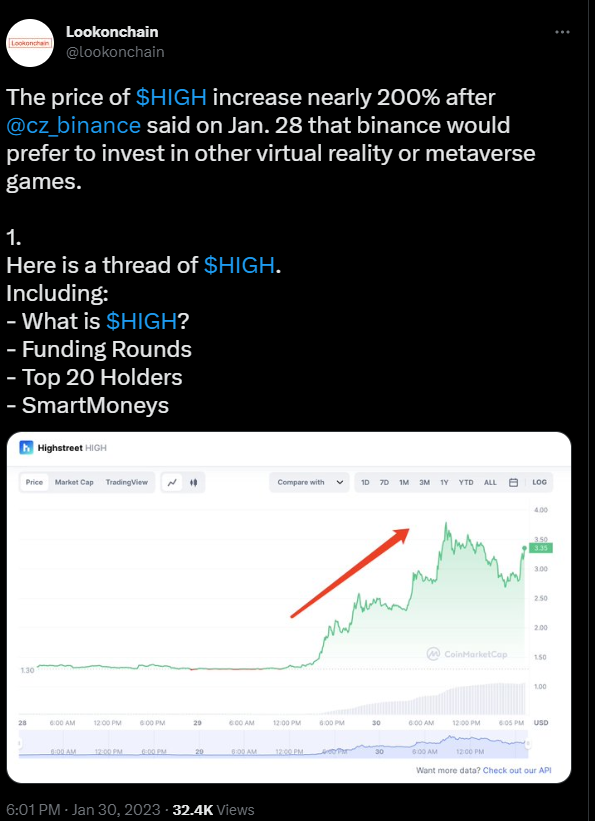

As of press time, HIGHS/USD is exchanging hands at $3.19, up 25% for the day. As per, on-chain analytic firm Lookonchain, the price of HIGHs rose 200% following Binance CEO, CZ’s statement that Binance would prefer to invest in other virtual reality or metaverse games.

Highstreet is an open-world cryptocurrency metaverse that integrates games, shopping, crypto, social networking, gaming, and NFTs under one MMORPG game.

Highstreet finds support near 21-day EMA

On the hourly chart, the Highstreet (HIGHs) price is taking support near the 21-day Exponential Moving Average (EMA) after testing the high of $4.22. The price continues to rise higher for the second consecutive day, in total, the price appreciated more than 190%.

The momentum in the price makes the Relative Strength Index (RSI) hold in the oversold zone. But, the recent price action also brings a negative divergence with the price. On the same line, the Moving Average Convergence Divergence (MACD) also retreated with bearish momentum.

A drop below the moving average could see $2.50 followed by the $2.00 mark. On the other hand, renewed buying pressure could take the price initially toward $3.50, and then bulls would keep their eye on $4.50