Cryptocurrencies have exhibited recovery in the past 8 hours, with the market capitalization remaining stable above $1.11 billion. According to a recent analysis, the markets are showing signs of an overbought condition, indicating that traders should remain cautious despite the positive returns.

As of now, crypto assets are mildly overvalued; however, it is not considered to be in a true danger zone for long-term investors. The analysis suggested that in the past when markets moved up, it was usually due to positions that may be slightly overvalued.

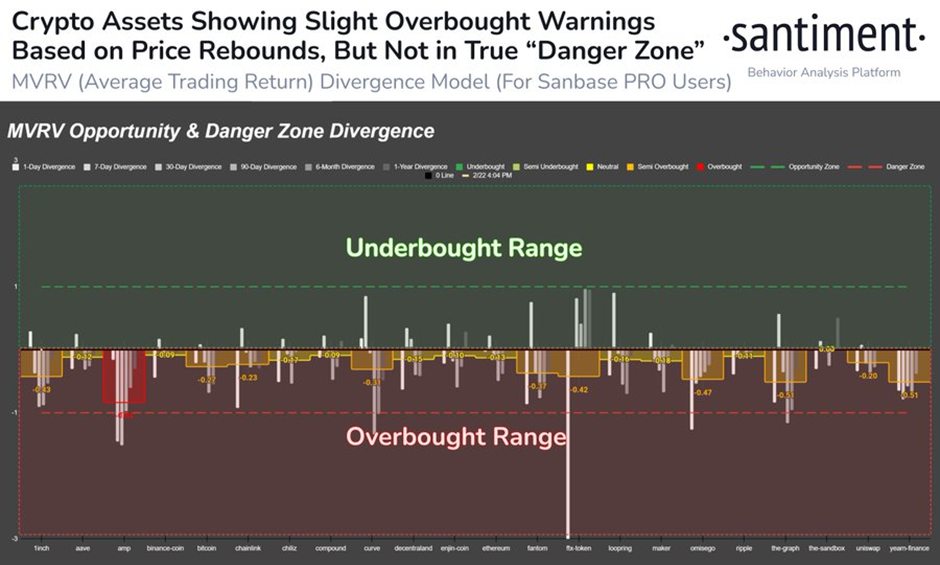

The MVRV Opportunity and Danger Zone Divergence, which measures how far the market is from its long-term average returns, shows that crypto assets are overbought but still not in the Danger Zone. The MVRVOD is currently at a reading of +2.5, indicating that the market is just slightly overbought and still has room to make more gains before entering into a true Danger Zone.

The current price rebound can be attributed to the recent price surge in Bitcoin and Ethereum, with both assets rallying in the past week. The market was at risk of another bear market following the crackdown on stablecoins by the SEC. However, the current price rebound came as a surprise for many.

The top ten assets by market capitalization were all in positive territory, with Bitcoin and Ethereum leading the charge. Bitcoin is trading at $24,453.49, while ETH price has remained above the $1,600 mark.ETH s trading at $1,667.44 with a 24-hour price change of 1.83%.

The altcoin performance of the day shows the top performer of the day is Stacks STX, up by 29%, followed by Optimism OP, up by 18.0%. The worst-performed altcoins are Filecoin, down by 8.27%, and Terra LUNA, down by 1.98%.

Bitcoin Technical Analysis

Bitcoin is trading above the 7-day EMA and is showing slightly overbought conditions. Bitcoin retraced below the $25,000 level that it had reclaimed earlier last week.

The closest resistance level is currently at $25,900. If the bulls break this level, the next resistance stands at $26,200. On the downside, the nearest support levels are seen at $24,200 and $23,700, respectively.:

The BTC/USD daily chart shows a slight bullish bias as the Relative Strength Index residing at 60.57 shows that the upside potential is limited. The Moving Average Convergence Divergence is rising. However, the histogram has flattened out, indicating that some of the momenta have been lost.

Ethereum Technical Analysis

Ethereum is trading at $1,667.11, down by 1.78% in the last 24 hours. The bulls have reclaimed the $1,650 level and are now looking to break above the $1,700 resistance level. The nearest support is at $1,590, followed by another one at $1,550.

On the daily chart, Ethereum is still trading in a bullish trend, as marked by higher highs and higher lows. The RSI is moving along the 50 lines, indicating that the market is still in equilibrium. The MACD shows a bullish crossover, suggesting that the price could break out of the $1,700 resistance level soon.

Overall, it looks like crypto markets are showing slightly overbought warnings as they rebound from their recent dip. While the MVRV Opportunity and Danger Zone Divergence suggests that the markets are still in a safe zone, a move above the $25,900 and $1,700 levels could help propel prices further.