Unlike predictable traditional markets, the crypto market’s volatility and unpredictability can quickly flip expected bull runs into bears. In the last 24 hours, traders and investors were shocked to see the entire crypto market trading in the red zone. The sudden change from bull to bear market underscores the crypto market’s ability to contradict trader’s expectations.

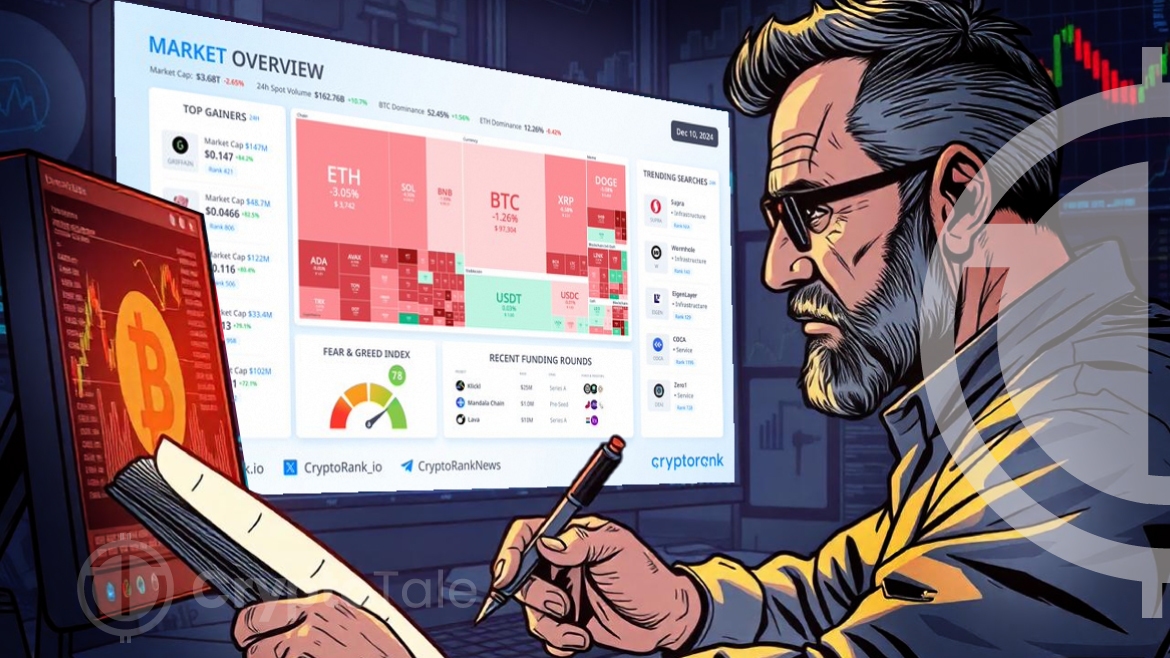

Despite the Fear and Greed Index indicating a value of 76, signaling strong buying sentiment among traders, the market’s sudden turn came as a surprise to most investors. According to CoinMarketCap at the time of writing, Bitcoin dropped by more than 1.5%, Ethereum fell by 3.23%, XRP declined by 5.67%, Solana dropped by 4.04%, with other cryptocurrencies also experiencing varying degrees of losses. Memecoins have also experienced similar declines with DOGE dipping by 8.21%, SHIB dropping by 12.06%. Meanwhile, PEPE fell by 1.54%, WIF decreased by 14.91% and BONK plunged by 14.40%.

Possible Reasons Behind the Sudden Change

Overbought Conditions

Usually, when traders predict a bull run is on the horizon, prices tend to inflate due to mass buying that creates overbought conditions. When coin prices surge, early investors and whales, who often operate behind the scenes, may cash out to secure their profits, triggering a large-scale sell-off.

Technical Indicators

Most traders use various technical indicators like Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Chaikin Money Flow (CMF) to analyse the chart. If these indicators denote bearish signals, it might cause the traders to sell their tokens to avoid any possible losses. For instance, the MACD line is trading below the signal line for Bitcoin, which typically represents a bearish signal.

Macro-Economic Conditions

Announcements regarding a spike in interest rates could have a heavy impact on the market conditions of cryptocurrencies. This is because investors tend to invest in more traditional and safer assets than cryptocurrencies. The macro-economic factors include gross domestic product (GDP), inflation rates, interest rates, and consumer spending.

Conclusion

The sudden shift from a bull market to a bear market highlights the inherent volatility of the crypto space. Factors such as overbought conditions and bearish technical indicators are among the main reasons for the downturn. Moreover, the crypto market’s ability to surprise traders serves as a constant reminder of its unpredictable nature.