The rate cuts announced by the Federal Reserve today have created an exciting opportunity for crypto investors. Fears of a looming recession, combined with the Fed’s decision to cut rates, have allowed Bitcoin and other cryptocurrencies to separate themselves from traditional banking and create a new store of value.

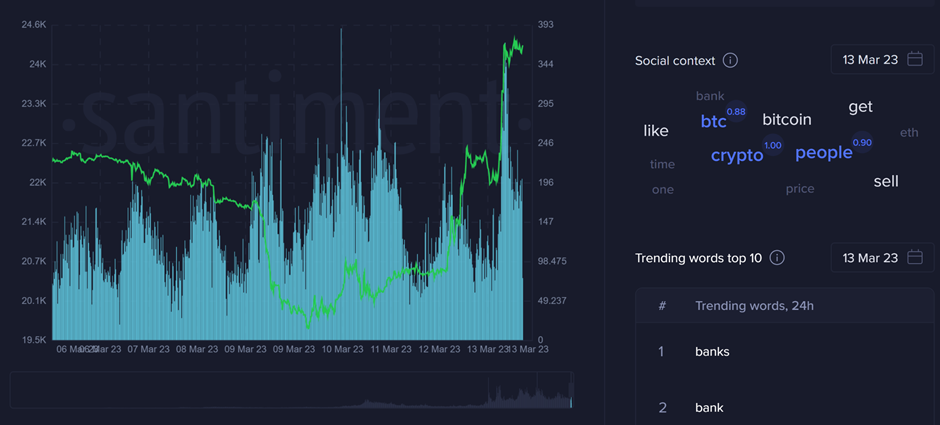

Cryptocurrencies rebound on Monday despite a turbulent start to the week. This can be attributed to a combination of factors – including the Silicon Valley Bank fallout, general dropoff in bank valuations, and value of fiat falling – and rumors that the Federal Reserve was pivoting from last week’s stance and may now cut interest rates.

The news of an impending rate cut seemed to give crypto maxis a sense of optimism that the Fed’s decision would create a separation between Bitcoin and other digital assets. This momentum has only grown in recent days as market sentiment and liquidity have both improved significantly.

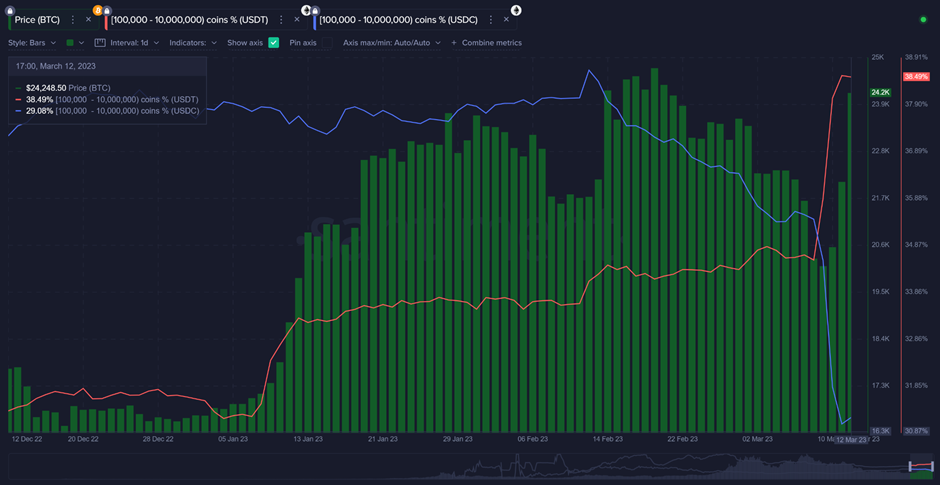

The immense flip between USDC (USD Coin) and USDT (Tether) whale holdings due to fears that USD Coin could potentially collapse has also had a ripple effect on the market. This has caused some investors to look toward Bitcoin as an alternative source of protection and wealth preservation in times of economic uncertainty.

As of now, this FUD looks like it may have been overblown, but that hasn’t stopped the large holders of these two stablecoins from having massively merged into Tether at the expense of USD Coin.

The dominance of BTC over other altcoins has also begun to rise once again, and this trend will likely continue in the near future. This is a positive sign for Bitcoin maxis, who have been hoping for the digital asset to make up lost ground against its competitors.

Anticipation and anxiety have been intensifying with talk of $25K, which we saw a drastic rise in when Bitcoin climbed above $ 24 K today. Yet if the excitement dissipates some, it could indicate that this level will be reached once more.

The Federal Reserve’s decision to cut interest rates appears to have given crypto-enthusiasts new optimism and hope that Bitcoin will continue to separate itself from other digital assets in the market.

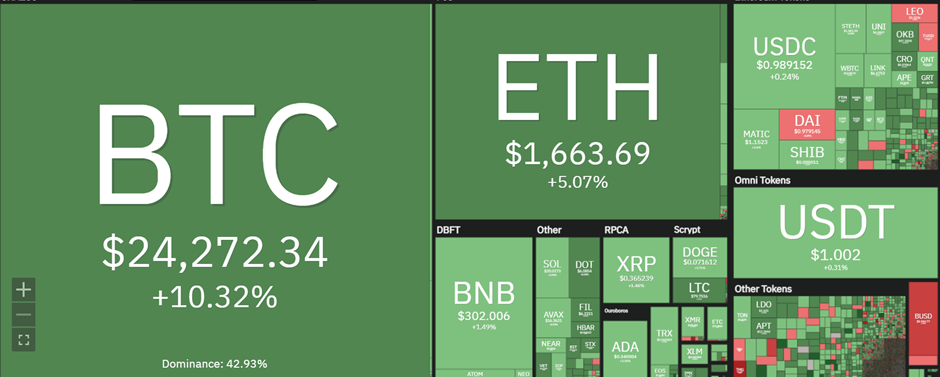

The crypto market has reacted positively to the news of a potential recession and rate cut. Bitcoin climbed more than 9.61% today and is now trading above $24,265.49 for the first time since March. Other cryptocurrencies, such as Ethereum and Litecoin, have also seen significant gains today in their respective markets.

Overall Market analysis

On March 14th, Bitcoin was keeping a close eye on the all-important $25,000 resistance level as markets eagerly awaited economic information from America. The BTC/USD pair remained resilient after multiple U.S. banks suspended their activities, sending crypto prices rocketing to unprecedented heights. Just one day before this momentous event, Bitcoin reached its greatest value since early March when the largest mass halt of American bank stocks in history occurred.

The BTC/USD struck a thorough bullish candle on March 14 that saw the pair race through its key resistance near $25,000. The BTC/USD entered a very narrow trading range in early European trading before pushing higher following the Fed’s decision to cut rates by 0.50%.

The rise in Bitcoin was accompanied by a surge across Ethereum and Litecoin markets, with both cryptocurrencies recording gains of more than 15%. The top gainers of the day are Conflux which has been on a bullish run since the start of March and is now up by more than 26%.

Ether has seen a dramatic rise of approximately 20% from its March 10 low of $1,369, as it soared to around $1,635 over the last two weeks – surpassing 3% growth today alone. This surge in price shows that Ethereum is indeed asserting itself among other cryptocurrencies and continues to triumph against market conditions.

This positive sentiment was also reflected in the overall market cap of cryptocurrencies, which jumped by more than $50 billion. This allowed the total capitalization to surpass $1.07 Trillion, up by 5% from the previous day.

As trading began, Bitcoin and altcoins experienced a surge in demand due to the intense volatility of certain bank stocks. The repercussions from two additional U.S. banks collapsing over the weekend had an impact that reached far beyond American shores – European banks also saw major losses as a result.

Looking ahead, the market will be closely watching how these factors play out and whether any additional rate cuts are announced by central banks. Most of the altcoins have gained value today, with BTC leading the pack with more than a 10% gain reaching $24,265.49 – its highest level since March 13th.