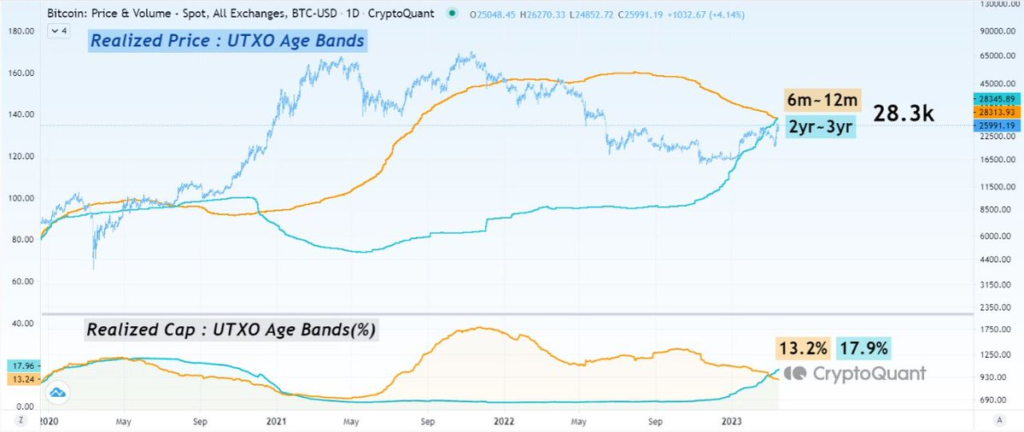

Bitcoin investors are keeping a close eye on the approaching key realized price level, which could trigger a strong resistance if breached. According to on-chain analysis using Realized Price UTXO Age Bands and Realized Cap, the 6-month to 12-month UTXO age band and the 2-year to 3-year UTXO age band are crossing at the critical level of 28.3k, which is close to the current BTC market price of 25.9k.

Analysts believe that this level represents a major cost-basis for long-term holders (LTHs) of Bitcoin and could serve as a strong support or resistance level depending on market sentiment. The Realized Cap for these two age bands accounts for a significant 31.1% of the total, indicating their importance in determining market trends.

Investors are wary of breaking through the 28.3k level, as it could trigger psychological resistance from those who are looking to recoup their initial investment. This resistance could create a challenging environment for Bitcoin bulls and lead to a temporary market downturn.

As the market braces for this critical level, Bitcoin enthusiasts and investors are eagerly awaiting the outcome, hoping for a bullish breakout that could signal the beginning of a new upward trend. However, caution is advised as Bitcoin’s notoriously volatile nature means that anything could happen.

In the meantime, investors are urged to keep a watchful eye on on-chain metrics such as Realized Price UTXO Age Bands and Realized Cap to better understand market trends and make informed investment decisions. The crypto market remains unpredictable, but with careful analysis and a bit of luck, investors may find themselves in a favorable position as Bitcoin’s price journey continues.

The current state of the Bitcoin market is also being impacted by various other factors, such as regulatory uncertainties, global economic conditions, and increasing competition from other cryptocurrencies. Some investors believe that Bitcoin’s role as a store of value and a hedge against inflation makes it a desirable investment option, while others are more skeptical due to its volatile nature.

However, regardless of one’s opinion on Bitcoin, it’s clear that the approaching key realized price level of 28.3k is something that cannot be ignored. As the market prepares for this critical juncture, investors are encouraged to exercise caution and take steps to mitigate risk in their portfolios.

Conclusion

In the end, only time will tell how Bitcoin’s price journey will unfold. As the market continues to evolve, investors must remain vigilant and adapt to changing conditions to stay ahead of the game. Whether Bitcoin experiences a bullish breakout or a temporary downturn, the crypto world is sure to provide plenty of excitement and opportunities for those who are willing to take on the challenge.