Cardano Network has recently gained traction among the cryptocurrency space due to its impressive run in the past week. It has jumped a remarkable +25% since December 30th .The surge has also brought with it more activity on the network as 28 new addresses have popped up that contain 1M ADA or more. This indicates that large scale investors are continuing to pour money into the project in order to capitalize on its current gains.

Trading volume for Cardano has also hit a 2-month high, with an increasing amount of large whale transactions being seen. This is a strong indication that the rally could be sustainable, as institutional investors are beginning to accumulate the digital asset on a larger scale. The trading volume is currently at $547,526,337.ADA is trading at $0.3155 after a minor pullback in the last few hours.

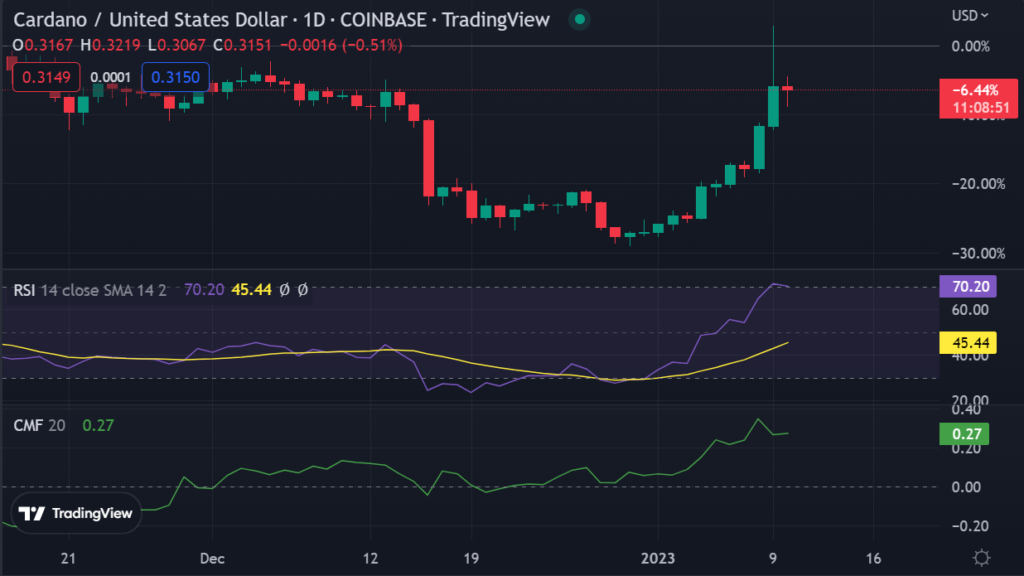

ADA/USD recent price analysis

Recent ADA price analysis shows ADA has retraced lower after hitting a high of $0.3401 on January 9th. Bulls are still attempting to keep price supported, however. With the recent price pullback, ADA is now trading above the $0.3150 level which is an important horizontal support level that needs to be watched carefully in the near-term.

If buyers can defend this support level, ADA could be on track to extend its gains and make a move towards $0.3500 or higher in the near future.If the retracement continues and sellers are able to push prices below the $0.3150 support level, ADA could find itself retracing back to $0.2900 or lower in the near-term.

The technical indicators on the 4-hour chart indicates that ADA is still in a bullish trend and that buyers are still looking for opportunities to capitalize on the current price surge. The RSI has pulled back from its overbought levels and is now trading in the mid-50s, indicating that there could be more room for gains.

The Moving Average Convergence Divergence (MACD) is also in a bullish trend and remains above the 0-level, pointing to more upside potential.ADA’s price is still trending above the 50 day Moving Average, which could indicate that the uptrend is still intact.

Overall, ADA’s price surge has been backed by increasing trading volume and large whale transactions. With the recent influx of institutional investors, it looks like this rally could be sustainable in the near-term.