- Breaking key levels at $0.087, DOGE shows potential for a trend reversal, fueled by its 10-year anniversary and nods from Tesla, targeting $0.11.

- Near exchange lows, $PYTH’s risk-reward ratio intrigues traders, following its historical pattern of “pump, dump, consolidate, rip.”

- $SOL and $TIA, tagged as ‘Solestia,’ present a ‘buy the dip’ strategy, leveraging Solana’s strength and Celestia’s anticipation.

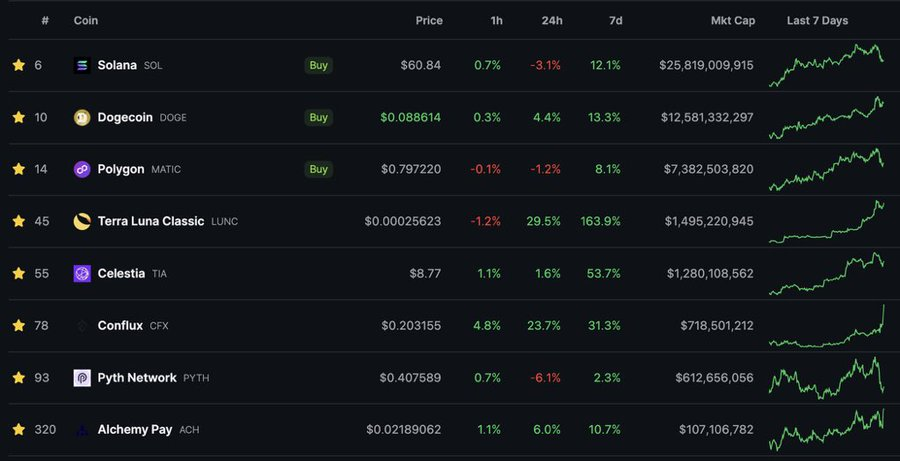

In a week marked by Bitcoin’s bullish momentum, crypto enthusiasts had their eyes on a diverse range of altcoins, eagerly anticipating potential breakouts and trend reversals. Miles Deutscher, a seasoned crypto analyst, shared his insights and watchlist for the week, shedding light on the intricacies of each coin’s technical setup and underlying narratives.

First on the radar was the meme-coin sensation, $DOGE. Breaking above a crucial horizontal level at $0.087, DOGE showcased signs of a trend reversal. The impending 10-year anniversary on December 8, coupled with the DOGE-1 mission to the moon and Tesla’s subtle nods on the Cybertruck checkout page, fueled optimism. Analysts believe that if market conditions remained favorable, DOGE could surge towards the next major level at $0.11.

$PYTH, a relatively new entrant, faced a critical juncture as it neared or touched exchange contract lows. Deutscher emphasized the importance of monitoring its reaction to these levels, considering the coin’s historical pattern of “pump, dump, consolidate, rip to new highs.” The risk-reward ratio for potential upside presented an intriguing opportunity for vigilant traders.

For $SOL and $TIA, collectively known as ‘Solestia,’ the strategy was clear: buy the dip. Leveraging the strength of the Solana narrative and the anticipation of Celestia as the “next Solana,” Deutscher saw deep dips as entry points for potential continuation.

The spotlight then shifted to $MATIC, with the upcoming Polygon Connect event on December 7. Deutscher, anticipating market volatility around conferences, expressed interest in a potential short hedge after the event, especially given Polygon’s teasing of impending announcements.

Gaming coins entered the scene with the imminent release of a GTA 6 trailer by Rockstar Games. Deutscher drew parallels with the OpenAI conference that previously influenced AI tokens, speculating that blockchain-related announcements could significantly impact the Game-fi sector.

Closing in on the Chinese crypto space, Deutscher noted the aggressive movement of $CFX and hinted at the possibility of another Chinese token run. Despite cautioning against playing laggards, he suggested that if the China season resumed, there might still be opportunities with coins like $ACH.

Lastly, $LUNC and $LUNA, while lacking fundamental value, continued to pump. Deutscher, mindful of the dangers of shorting in a bullish market, added them to his watchlist, anticipating potential reversals if Bitcoin failed to break $42k.

As the crypto market navigates through these dynamic scenarios, traders and enthusiasts remain on the edge, awaiting the unfolding of these narratives and the impact they may have on their chosen altcoins.