- XRP’s unique market trajectory defies expectations, with price at $0.620630 despite $1B+ trading volume.

- SEC v Ripple case outcome key to XRP’s future, pivotal in crypto regulation clarity.

- Amidst regulatory uncertainties, XRP’s RSI at 48.95 suggests it may be approaching oversold territory.

As the digital currency space continues to evolve, XRP, a prominent player in the crypto market, finds itself at a crucial juncture. Despite recent fluctuations and regulatory challenges, XRP’s path ahead is laden with potential and pivotal developments.

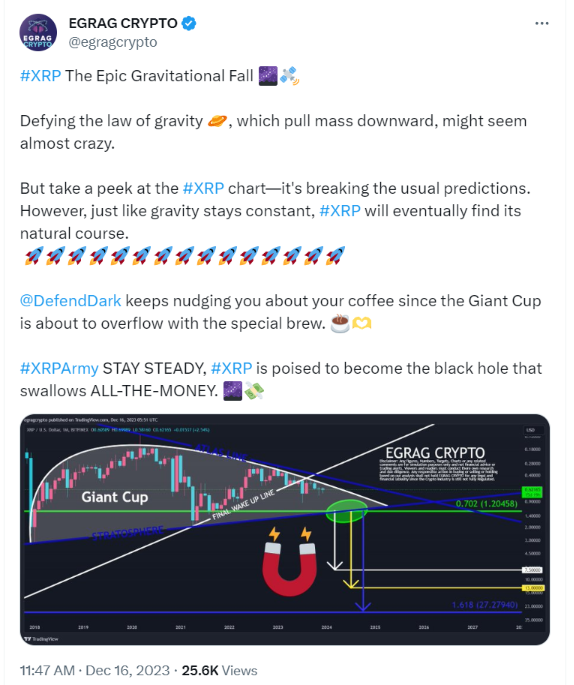

As highlighted by crypto analyst EGRAG CRYPTO, XRP has been defying typical market predictions, demonstrating a unique trajectory in the crypto landscape. The recent market behavior of XRP, a major cryptocurrency, has been drawing considerable attention from investors and analysts due to its unexpected trend deviations. Currently, XRP’s price stands at $0.620630, and it has seen substantial trading activity, recording a volume exceeding $1 billion within a 24-hour span.

Despite the high trading volume exceeding $1 billion in 24 hours, XRP’s value has faced a downturn. The currency has undergone a slight decline of 1.90% in just the last day and a more noticeable drop of 10.30% over the past week, contrasting with its active trading scenario.

Amidst this market behavior, the Relative Strength Index (RSI) for XRP hovers around 48.95, indicating a neutral position but edging closer to the oversold territory. Additionally, the Know Sure Thing (KST) momentum oscillator points to a bearish trend, with both the KST line and its signal line heading downward.

The ongoing SEC v Ripple case is a focal point in XRP’s journey. The crypto market eagerly anticipates the case’s conclusion, expected before the summer of 2024. After the completion of remedies-related discovery by February 12, 2024, a decision on an appropriate penalty for XRP sales to institutional investors will follow. This case’s outcome could have far-reaching implications for XRP and the broader crypto market.

In a notable development, Judge Analisa Torres ruled in July that XRP is not always a security, a decision that the SEC has shown intent to appeal. The Supreme Court might ultimately settle this dispute, potentially providing clarity to the crypto market regarding the classification of XRP.

Moreover, the broader crypto market, including XRP, faces a choppy year ahead in 2024. Predictions suggest ongoing regulatory challenges, with Congress agreeing in principle on crypto regulation but differing on the best approach. This indecision could leave U.S. crypto firms in limbo, hindering their competitive edge globally.

XRP’s journey through 2024 appears to be a blend of uncertainty and opportunity. The outcome of the SEC v Ripple case, market dynamics, and evolving regulatory frameworks will play crucial roles in shaping XRP’s future. As the crypto market watches closely, XRP could emerge as a significant player, potentially influencing the landscape of digital currencies.