- Avalanche experiences a 10% weekly gain, leading the altcoin surge, but faces resistance, indicating a potential price correction.

- Solana trades below the crucial $100 mark, facing resistance at $106, indicating potential retests at lower levels if bearish trends continue.

- Cardano struggles below $0.50, with current market forces pushing for support reevaluation at $0.49 and resistance at $0.52.

As the crypto market entered rebound mode this week, altcoins, including Avalanche (AVAX), Solana (SOL), and Cardano (ADA), have emerged among the top gainers in the top 20 crypto market rankings.

Avalanche leads the list with a weekly gain of 10%, while Solana follows closely behind, recording an increase of 9%. Cardano has, however, recorded a mere increase of 4% as its price drops below $0.50.

Following the shift in the outflow in Grayscale Bitcoin Trust ETF this week, the crypto market has seen bullish momentum, with most of the coins retracing toward recovery from the recent price slump led by Bitcoin. GBTC’s outflows have decreased significantly as it started recording inflows for the first time in a week, shifting the market’s outlook.

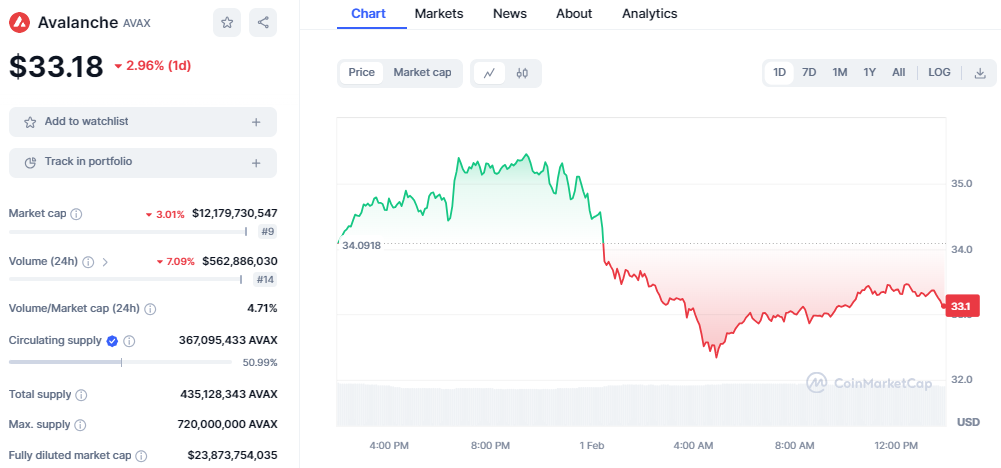

As of this writing, Avalanche is exchanging hands at $33.18, down by 3% in the past 24 hours. AVAX has been trading on a downtrend over the past few days following the wide market turmoil. Additionally, the market capitalization and the daily trading volume have dropped, too, as they stand at $12 billion and $562 million, respectively.

Avalanche formed an uptrend pattern, rising from the $30 level, and faced resistance at $37, correcting toward the $30 mark again. The bears have held their ground tight as AVAX fails to break above the immediate resistance at $35. However, the support level at $32 has held tight, whereby a break below this level could lead to a retrace at $30.

Solana, among the top-performing coins over the past months, trades below the $100 key level today. Currently, SOL is trading at $96.15 in the negative territory, down by 3% on the daily timeframe. The market cap has declined to $41 billion, while the 24-hour trading volume has seen an increase of 3%, suggesting an increase in buying pressure.

SOL steadily climbed from the $85 level, forming an ascending triangle pattern surpassing $100, facing a stiff resistance at $106. The $100 level has proved to be a key level for the bulls as SOL struggled to maintain above it. As the bearish persists in the SOL market, recording a monthly decrease of 17%, SOL could retest the lower levels at $85 – $80 if the market dynamics dont shift.

Finally, Cardano’s market is on the decline, too, as the price remains below the $0.50 key level. ADA broke above the $0.50 mark after a month of downtrend, which says the price dropped from $0.63 to $0.45. However, the bears are on the lead again today as the price faces further decline, seeking support at $0.49.

Amid the rise in funding rates, which suggests a bullish momentum as investors pay high fees to keep their long positions open, ADA has failed to showcase momentum toward the upper side. As of press time, ADA is trading at $0.4921, a decrease of 1.71 in the past 24 hours. Resistance for ADA remains at $0.52, while the immediate support is $0.49. A drop below this point could lead to a retrace of $0.47, while a reversal in the trend could push ADA above $0.52.