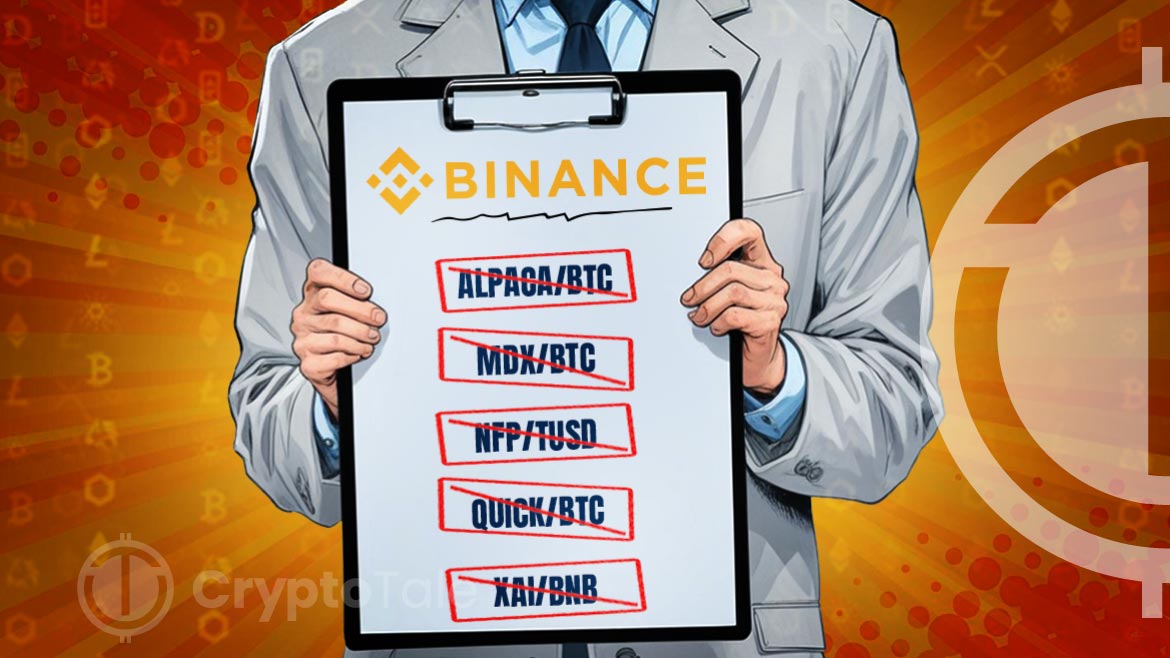

In a bid to protect users and ensure a high-quality trading environment, Binance has announced the delisting of several spot trading pairs. This decision follows their routine market reviews which consider factors like liquidity and trading volume.

Binance, the crypto exchange, has identified five spot trading pairs to be delisted due to insufficient liquidity and low trading volumes. The pairs affected are ALPACA/BTC, MDX/BTC, NFP/TUSD, QUICK/BTC, and XAI/BNB. Trading for these pairs will end precisely at 03:00 (UTC) on June 14, 2024. Users who trade in these pairs should take note of this schedule to make the necessary adjustments to their portfolios.

It’s important to note that the delisting of these spot trading pairs will not affect the availability of the tokens involved on Binance Spot. Users will still have the opportunity to trade the base and quote assets of these pairs using other trading pairs available on the platform. This move ensures that while the specific pairs are being removed, the overall accessibility to the tokens remains unaffected, allowing for continued trading flexibility and options for users.

In conjunction with the delisting, Binance will also terminate Spot Trading Bots services for the mentioned trading pairs at the same time: 03:00 (UTC) on June 14, 2024. Users who utilize these bots for trading the affected pairs are advised to update or cancel their bots before this deadline to prevent any potential losses. This step is crucial for users relying on automated trading strategies to mitigate any risks associated with the cessation of these services.

This announcement underscores Binance’s urge to maintain a robust and efficient trading environment. Users are encouraged to stay informed about such updates to manage their trading activities effectively.

In other reports, Mastercard’s decision to halt its services with Binance last year was primarily due to the crypto exchange’s legal troubles in the United States. Binance faced intense scrutiny from the U.S. Securities and Exchange Commission (SEC) and the U.S. Commodity Futures Trading Commission (CFTC), which culminated in a massive $4.3 billion settlement with the U.S. Department of Justice (DOJ) over charges of facilitating money laundering. This period also saw the resignation of Binance’s CEO, Changpeng Zhao, who later faced legal repercussions.