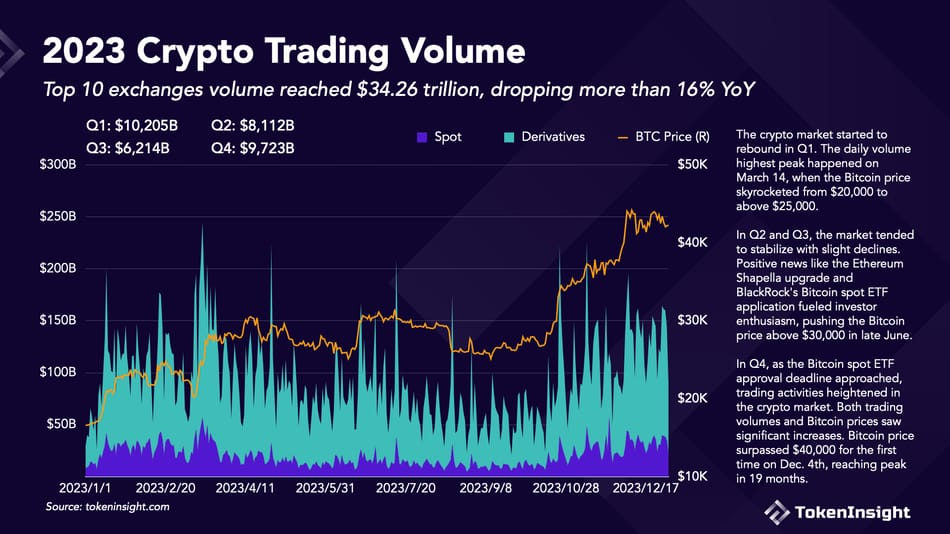

Despite initial difficulties in 2023, the crypto industry witnessed a remarkable comeback fueled by positive developments like Ethereum’s Shapella upgrade and BlackRock’s Bitcoin ETF application. However, this recovery unfolded differently for centralized exchanges (CEXs) and decentralized exchanges (DEXs), as reported by the latest report by Token Insight, a prominent crypto research firm.

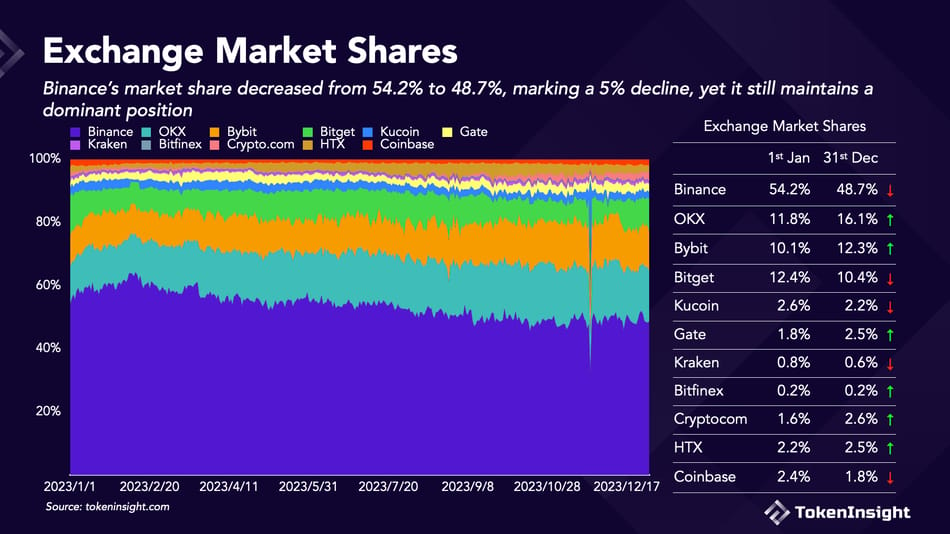

In Token Insight’s report, it has been revealed that the leading cryptocurrency exchange, Binance, has faced a dip of 5% in its market share. The exchange’s market share dropped from 54.2% to 48.7%, owing to regulatory issues, the resignation of CEO Changpeng Zhao, and the end of Binance’s Zero-Fee Bitcoin promotion. However, Binance managed to retain its top spot, because of its established user base and swift recovery from the departure of Zhao.

While Binance faced turbulence, OKX and Bybit utilized the opportunity to increase their market share by 4.3% and 2.2%, respectively, putting them on par with Binance. This growth highlights the increasing diversification of the exchange landscape, with competitors making inroads at Binance’s dominant position.

The report also pointed out that trading is heavily tilted towards derivatives, with Bybit, Bitget, and OKX witnessing over 90% of their volume in this segment. Binance and KuCoin, though less reliant, still saw derivatives as a major driver, constituting 70-80% of their trades. On the other hand, Kraken bucked the trend, with over 80% of its volume stemming from spot trading, showcasing the enduring appeal of direct asset exchange.

Decentralized exchanges (DEXs) witnessed a stable 2.83% of the total volume throughout the year. Orca emerged as the biggest winner, riding the Solana ecosystem’s resurgence to capture a 9.22% market share by year-end.

Meanwhile, established DEX players like GMX and dYdX saw muted growth or even declined slightly, indicating DEXs still need to quite live up to their disruptive potential. However, prominent blockchain figure Ali eyes GMX for a potential breakout, citing a head-and-shoulders pattern and a bullish rally target of $90 once the price decisively surpasses $59.

The report also stated that in the fourth quarter of 2023, the looming possibility of a BlackRock Bitcoin ETF sent shockwaves through the market which in turn resulted in boosting both trading volume and BTC’s price. This showcases the growing influence of traditional financial giants in shaping the crypto landscape, further blurring the lines between established powerhouses and emerging technologies.