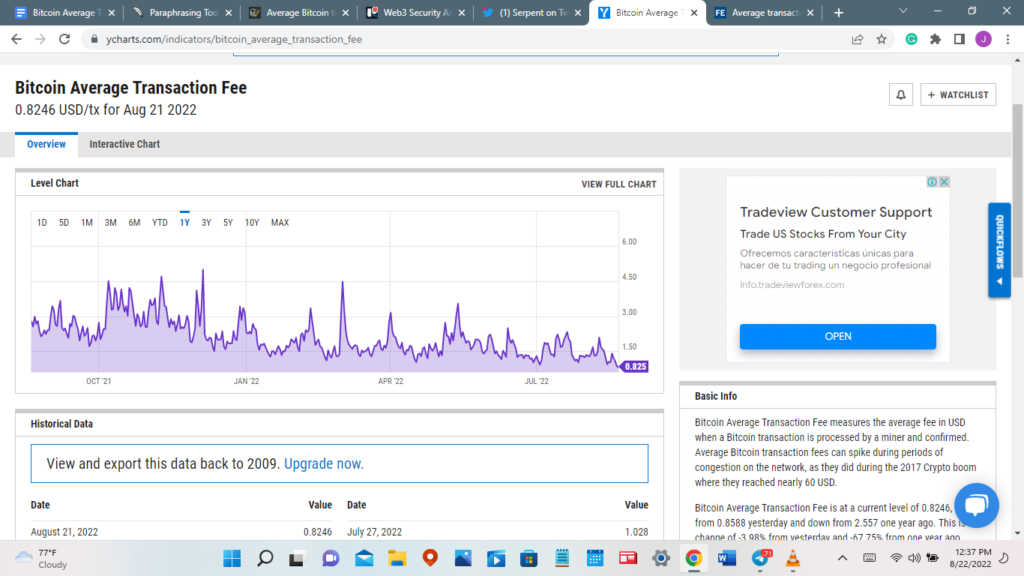

According to data from YCharts, the average cost of doing an average Bitcoin transaction dropped to $0.825 on August 22. This is the first time in over two years that the price has been less than $1. The Bitcoin ecosystem has also been hampered in the past by relatively high transaction fees, which are projected to increase to over $60 in 2021, representing an extremely high charge.

According to an explanation provided by Cointelegraph, large transaction fees imposed by blockchain networks are detrimental to the users, particularly when conducting transactions of modest value. For instance, at the height of the buzz around nonfungible tokens (NFTs), transaction costs on the Ethereum blockchain increased by many orders of magnitude, causing regular users to experience stress.

In general, transaction fees will increase if there is a high level of utilization of the Bitcoin network. Competition exists between transactions for the limited space available in Bitcoin blocks. This results in users racing against one another to get their transactions included in the next block, which leads to increased rivalry for transaction fees.

Meanwhile, the difficulty of mining new Bitcoin blocks is gradually lowering as miners recover from a chronic lack of chips and acquire access to cheaper gear. This trend is expected to continue for the foreseeable future.

Meanwhile, the decline in the price of cryptocurrencies has also resulted in a reduction in the number of persons mining these currencies.

Since reaching a peak of $69,000 in December of 2021, the price of bitcoin has dropped by more than 60 percent. According to statistics provided by CoinMarketCap, the value of the standard cryptocurrency had reached $21,239 at the time this article was written.