- CryptoQuant’s analysis sees an ongoing Bitcoin bull run with no end in sight, backed by historical cycles and upcoming market events.

- A significant drop in Bitcoin on exchanges over four years hints at investor accumulation, potentially curbing end-cycle supply spikes.

- Despite recent dips, platform metrics show strong market sentiment, with decreased miner selling pressure and shifting retail interest indicators.

Renowned analytical platform CryptoQuant has unveiled, shedding light on the current state of Bitcoin following a recent selloff and providing guidance for traders navigating the volatile market. Amidst the euphoria of breaking new highs in Bitcoin and witnessing a surge in altcoin activity over the past couple of weeks, the cryptocurrency market has again retraced below previous peaks.

In a recent X post, the platform revealed that there is no significant indication that the ongoing bull run in the Bitcoin market is ending. Historical cycles of Bitcoin have shown that the prices tend to rise beyond their previous all-time highs. The upcoming Halving events are expected to provide further impetus to the market, which means that the chances of Bitcoin prices moving upward in the near future are positive.

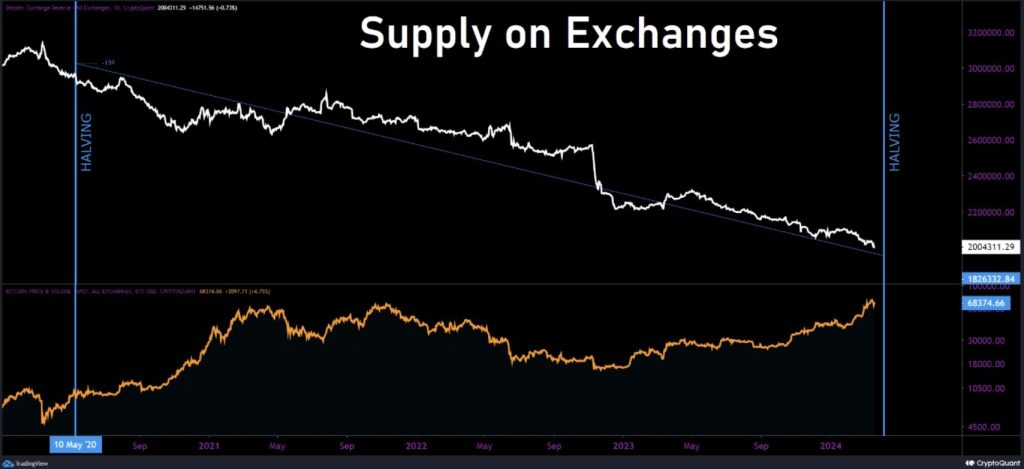

According to a recent report, the amount of Bitcoin held on exchanges has decreased by almost 40% over the past four years. This indicates a trend of investors accumulating and holding onto their Bitcoin, which could limit the supply surge typically seen at the end of a market cycle. This scarcity-driven dynamic is an important insight for cryptocurrency market investors.

Source: Image by CryptoQuant

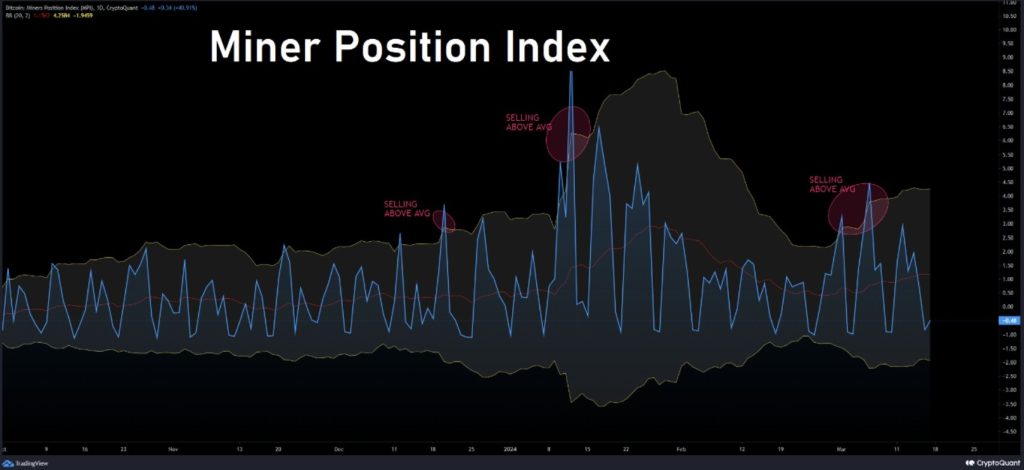

The analysis also delves into metrics such as the Net Unrealized Profit and Loss (NUPL), Miner Position Index (MPI), Bitcoin Netflow, and Market Cap to its Realized Cap (MVRV), offering a comprehensive view of market sentiment and dynamics. While NUPL reflects a moderately bearish outlook on lower time frames (LTF), it indicates room for further growth on higher time frames (HTF).

Source: Image by CryptoQuant

Additionally, MPI data suggests that there has been low selling pressure from miners recently, with no significant signs of a mass selloff. Furthermore, the platform analysis touches upon market sentiment indicators, including a notable drop in the ranking of the Coinbase App and a decline in Google Trends searches for “Bitcoin” following a peak, indicating a potential shift in retail interest.

Source: Image by CryptoQuant

Despite the recent decline in Bitcoin’s price, CryptoQuant’s analysis suggests that the overall bullish sentiment remains strong. The trend of accumulation, combined with positive on-chain metrics and sentiment indicators, provides hope for traders and investors looking for long-term growth in the cryptocurrency market.