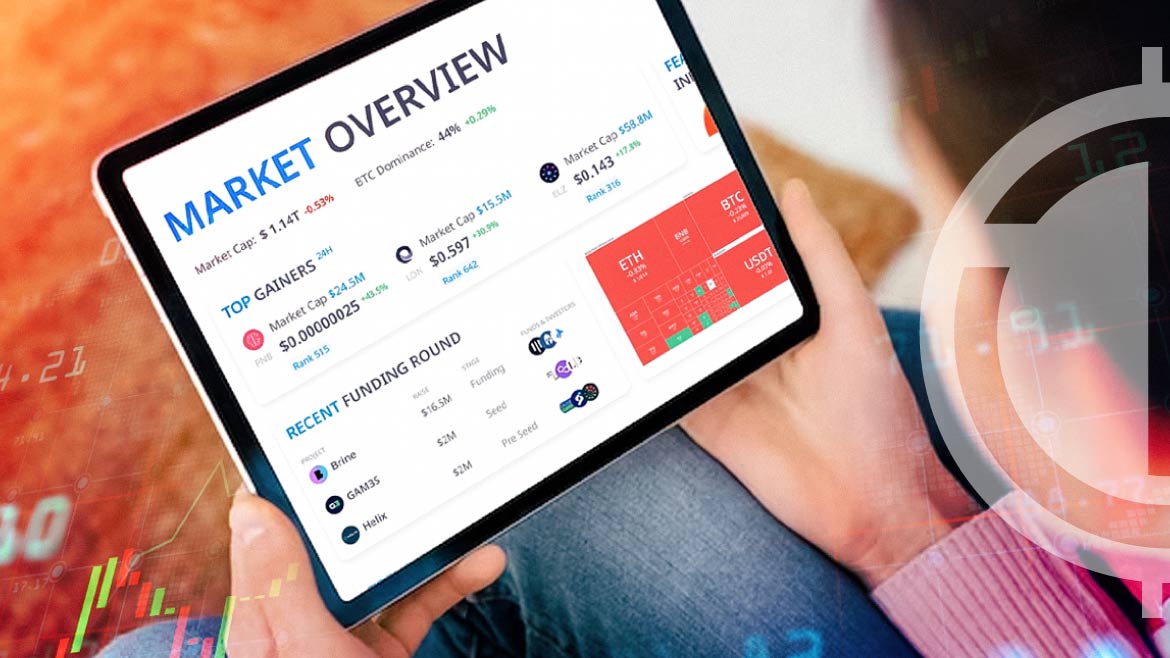

- CryptoRank reports a significant slump in the cryptocurrency market, with Bitcoin trading below $26,000.

- Market capitalization has dipped to $1.14 trillion, marking a 0.53% decrease from previous levels.

- Bitcoin’s market dominance has slightly risen to 44%, suggesting its continued influence despite low prices.

According to CryptoRank, a crypto market data aggregation and analytics platform, the cryptocurrency market has been experiencing a significant slump, with Bitcoin trading below the $26,000 mark. This decline is not isolated to Bitcoin (BTC) alone; the top 10 cryptocurrencies also face a downturn. Notable mentions include Ripple (XRP), which has seen a 3.4% decrease, Solana (SOL), with a 2.31% drop, and Cardano (ADA), which has declined by 1.61%:

The overall market capitalization has also taken a hit, currently at $1.14 trillion, a 0.53% decrease from previous levels. This decline has led to a sense of caution among investors and traders, as reflected by the Fear & Greed Index, which currently stands at 40, indicating a sentiment of fear in the market.

While some attribute this decline to market volatility, others believe external factors could influence this downturn. Bitcoin’s dominance in the market has slightly increased to 44%, a 0.29% uptick. This could imply that Bitcoin still significantly influences the market despite its low trading price. However, more than the increase in Bitcoin’s market dominance is needed to offset the overall decline in the market capitalization.

As per CoinMarketCap, SOL is currently experiencing a bearish trend, with its price dropping by 3.04% to trade at $17.84. Similarly, ADA has seen a decline of 2.08%, now trading at $0.245. XRP also hasn’t been spared, witnessing a 3.96% decrease in the last 24 hours.

Part of the community speculates that the current market conditions could be a “cooling-off” period after a series of highs. However, there is also a growing concern that this could begin a more prolonged bear market. The Fear & Greed Index, often considered a reliable indicator of investor sentiment, further substantiates these concerns. A score of 40 on the index is generally considered a sign that investors are cautiously approaching investments, possibly anticipating further declines.

The cryptocurrency market is currently in flux, with leading currencies like Bitcoin, XRP, and Solana, and Cardano all trading in the red. Market capitalization has also decreased slightly, leading to a cautious atmosphere among investors. While it is too early to determine the long-term implications of this market behavior, the prevailing sentiment is cautious and uncertain.