- The market shows resilience as Mt. Gox distributes BTC to creditors, with minimal impact on trading volumes.

- A decline in Bitcoin deposit addresses suggests investors are holding onto their BTC, potentially anticipating future price gains.

- With BTC dipping below $66,500, investors focus shifts to $63.6k as a critical support level.

The distribution of Bitcoin from the defunct crypto exchange Mt. Gox to its creditors has started, putting pressure on the Bitcoin market. According to CryptoQuant, Mt. Gox creditors received their Bitcoin on Kraken without significant spikes in trading volume or Bitcoin outflows. This initial calm is seen as a positive sign by market watchers, suggesting that the impact might not be as severe as initially feared.

The recent movement of approximately 37,477 BTC, valued at $2.5 billion to Kraken and other exchanges like Bitstamp and Bitbank, marks a critical moment in Bitcoin’s market dynamics. This transfer is part of a larger distribution process from Mt. Gox, a defunct cryptocurrency exchange. Despite the sizable inflow, the expected market disruption did not materialize immediately, which analysts view as a potentially positive sign. However, the full impact of these distributions may unfold gradually, particularly as different time zones react to the news.

In parallel, Bitcoin’s price has dipped below the critical $66,000 support level, especially significant for holders with a 1-3 month holding period. This level is crucial as it represents the average purchase price for a substantial portion of the market. With prices slipping further, the next support level to watch is around $63,600, which correlates with the average purchase price for 3-6 month holders. This ongoing price movement adds a layer of uncertainty to the market’s immediate future.

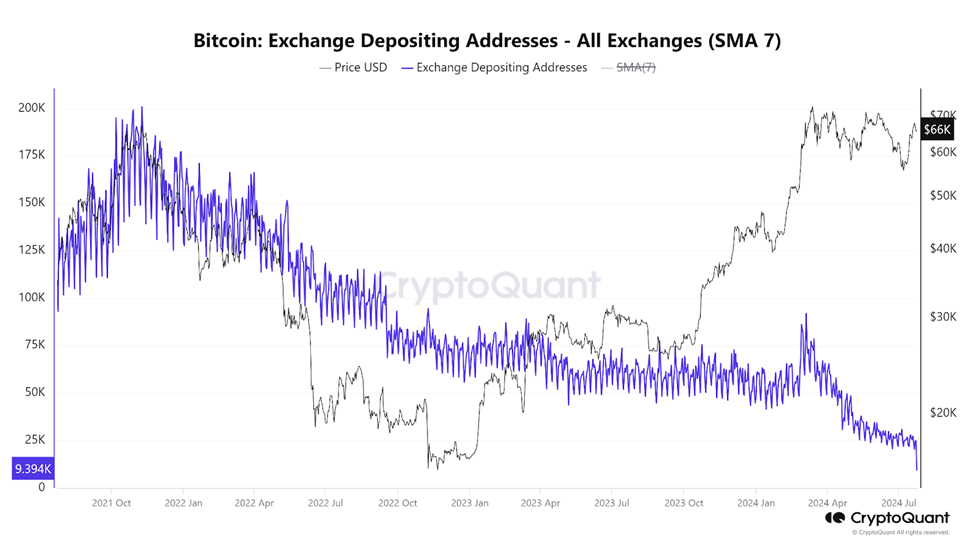

Bitcoin Crash: $683M Positions Wiped Out Amid Mt. Gox PayoutsAdding to the complexity, the market has seen a recent trend of decreasing Bitcoin deposit addresses across all exchanges, reaching a low of 10K. This decline suggests a shift in investor behavior, with fewer participants willing to sell their holdings.

Source: CryptoQuant

This reduction in sell-side pressure could imply a more bullish sentiment, as investors may be anticipating higher future prices. Such behavioral trends could play a significant role in stabilizing or even boosting Bitcoin’s price, provided demand remains steady or increases.

Meanwhile, the first net outflows from spot Bitcoin ETFs after a 12-day streak of inflows also reflect a nuanced investor sentiment. As the market absorbs these developments, attention is shifting to the upcoming introduction of spot Ethereum ETFs, which could further influence market dynamics.