- Bitcoin’s surge past $52k highlights a liquidity boom, crucial for stable trading and reduced price volatility.

- Rising Bitcoin ETF inflows and the upcoming halving event signal bullish market sentiment and potential price increases.

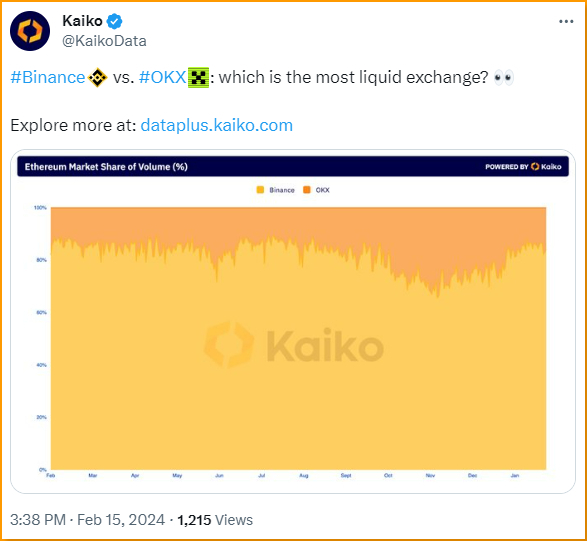

- Debate intensifies over Binance vs. OKX as the most liquid exchange amidst Bitcoin’s growing mainstream acceptance.

Amidst the surging interest in Bitcoin, the debate over the most liquid exchange between Binance and OKX continues to brew as per Kaiko, a blockchain analytics firm. Bitcoin recently surged past the $52,000 threshold, now trading at $52,345.08, marking a 1.53% increase over the last 24 hours. This milestone brings into focus the growing liquidity in the market, an essential aspect for traders seeking smooth transactions and reduced price fluctuations.

In recent developments, Bitcoin’s liquidity surge has been noted as the most significant in years, as further highlighted by Kaiko. This surge in liquidity, coupled with growing open interest in Bitcoin contracts reaching close to the all-time high, indicates a thriving market sentiment and heightened activity in derivatives markets.

Moreover, the rise in liquidity is complemented by the influx of Bitcoin into ETFs, signaling a shift in investment patterns. Custodians are currently holding approximately ten times more BTC to back Bitcoin ETF shares than the amount entering the market through mining processes. This trend, highlighted by Gemini co-founder Cameron Winklevoss, underscores a growing institutional appetite for Bitcoin exposure.

Furthermore, the impending Bitcoin halving, expected to slash mining rewards by 50% in April, presents an intriguing prospect for market dynamics. Historically, halving events have been associated with bullish trends in Bitcoin prices. As the rate of new BTC entering the market decreases post-halving, the potential for a bullish price surge gains traction, as observed in previous halving cycles.

On the Wall Street front, the approval of Bitcoin ETFs has ignited a flurry of interest, with BlackRock’s iShares Bitcoin Trust (IBIT) witnessing substantial inflows. The recent influx of $500 million into IBIT catapults the fund into the top echelons of ETFs, underlining the growing investor appetite for Bitcoin exposure in traditional financial markets.

Consequently, the ongoing narrative surrounding Bitcoin’s liquidity, coupled with the evolving landscape of ETF investments and the looming halving event, paints a picture of optimism and anticipation within the cryptocurrency market. As Bitcoin continues to assert its position as a mainstream asset, the debate over the most liquid exchange remains a pertinent topic among traders and investors alike.