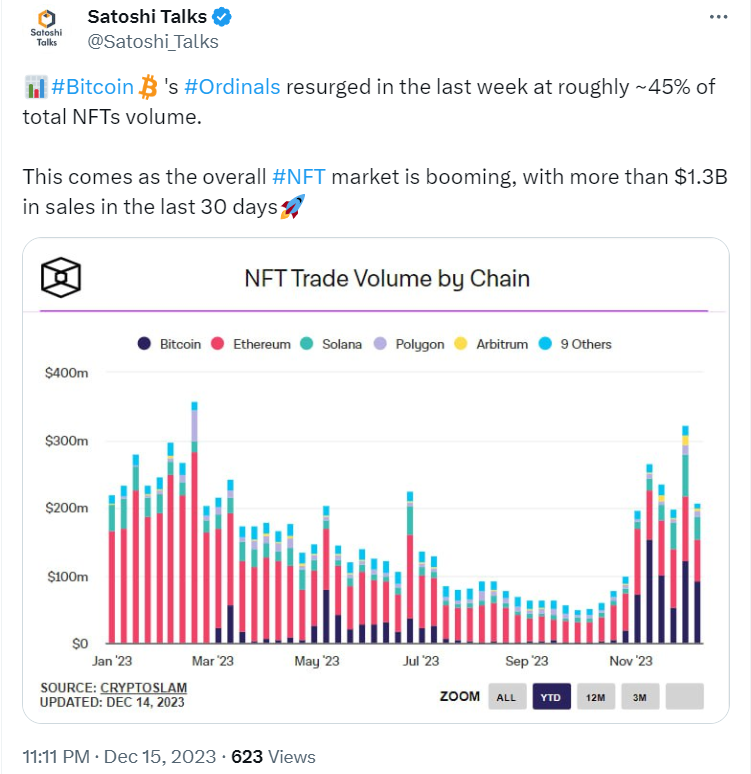

- The Analyst unveiled Bitcoin’s influential surge, accounting for 45% of NFT volume, marking a pivotal moment in the crypto-NFT landscape.

- Amidst a $1.3 billion sales surge in 30 days, analysts note heightened market activity, sparking debates and discussions among enthusiasts and investors.

- Bitcoin’s reemergence challenges Ethereum’s NFT dominance, hinting at evolving investor preferences and potential reshaping of digital asset transactions.

In a pivotal move, renowned crypto analyst Satoshi Talks unveiled a notable resurgence in Bitcoin’s influence within the NFT (Non-Fungible Token) space. The revelation indicated that Bitcoin’s Ordinals surged, contributing to approximately 45% of the total volume of NFTs over the past week.

This surge in Bitcoin’s prominence within the NFT realm arrives amidst a significant boom in the overall NFT market. The analyst indicated a staggering $1.3 billion in sales within the last 30 days alone, marking remarkable growth and heightened market activity in the NFT space. This disclosure has ignited discussions and debates among crypto enthusiasts, investors, and analysts, highlighting the shifting dynamics within the crypto sphere.

The emergence of Bitcoin as a dominant force within the NFT market hints at shifting trends and preferences among investors and collectors. Traditionally associated with Ethereum, the leading blockchain for NFTs, Bitcoin’s resurgence in this domain suggests a potential diversification and reevaluation among market participants.

While Ethereum has long been considered the primary blockchain for NFT transactions due to its smart contract capabilities and established infrastructure, Bitcoin’s reinvigorated presence signals a redefinition of the market landscape. Integrating Bitcoin, with its widespread recognition and market capitalization, into the NFT space could reshape the dynamics of digital asset transactions.

Over the past month, the $1.3 billion in NFT sales underscores the growing mainstream interest and adoption of digital collectibles and assets. With Bitcoin’s renewed significance, the market anticipates further exploration and evolution in the intersection between cryptocurrencies and the burgeoning NFT sector.

As Bitcoin continues to assert its influence within the NFT space, experts and enthusiasts eagerly await further developments and potential implications for cryptocurrency and digital collectibles markets. Satoshi’s revelation catalyzes deeper analysis and speculation about the future trajectory of these intertwined sectors.