- Bitcoin (BTC) drops below $61K, reflecting a 2% decline amid market-wide losses.

- The Fear & Greed Index hit 39, indicating rising fear among cryptocurrency investors.

- Despite the market downturn, altcoins like PROS and SILLY have posted impressive gains.

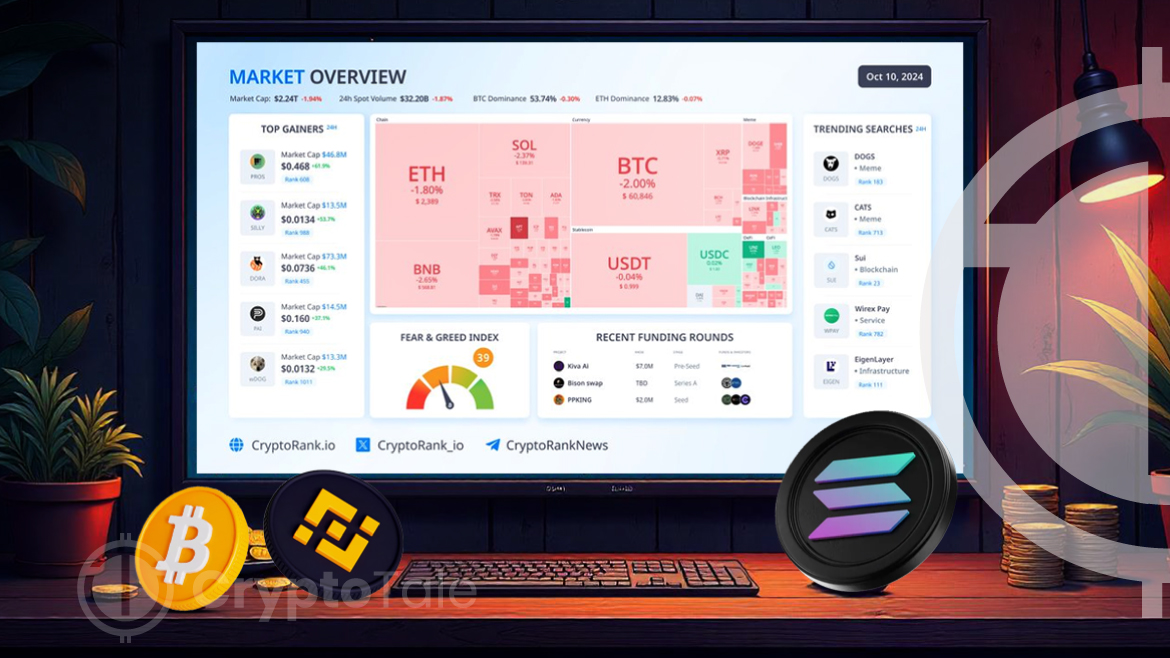

Analytical platform CryptoRank reported that Bitcoin is currently trading below $61,000. This comes as the larger market for digital assets also appears shaky, with the top ten coins all down today. From these, Binance Coin (BNB) is down by 2.65%, Solana (SOL) is down by 2.37%, and Bitcoin (BTC) is down by 2%.

📈Market Overview#Bitcoin trades below $61K. The top-10 cryptos are traded in red zone:$BNB -2.65%$SOL -2.37%$BTC -2.00%

— CryptoRank.io (@CryptoRank_io) October 10, 2024

Market capitalization: $2.24T (-1.94%)

The #BTC dominance: 53.74% (-0.30%)

Fear & Greed Index: 39 (Fear)

👉 Top Gainers

Prosper $PROS +61.9%

Silly… pic.twitter.com/Qtd4vtOAHx

Crypto Market Sentiment

According to platform findings, the total market capitalization of cryptocurrencies has also dropped, falling by 1.94% to $2.24 trillion. The market was somewhat slightly different, with Bitcoin’s share reducing slightly to 53.74% from the previous 53.10%. Similarly, other tools such as the Fear & Greed Index, which is used to measure market sentiment, presently stand at 39, which shows that investors are filled with fear.

Short-Term Gainers in Altcoins

Even though the top cryptos are down, there are a few altcoins doing much better than the others. The highest gainers for the week were Prosper (PROS), which appreciated by 61.9%, Silly Dragon (SILLY), which gained 53.7%, and Dora Factory (DORA), which rose by 46.1%.

Other day gainers include ParallelAI (PAI), which appreciated by 37.1%, and Wrapped Dog (wDOG), which rose by 29.5%. Altcoins remain generally in the red zone, but some of them at least provide short-term gains for those who are less patient.

Bitcoin Could Reach $90K if Trump Wins U.S. Election: ReportThe recent fall of Bitcoin has alarmed investors even more, especially when the Fear & Greed Index remains in the ‘fear’ territory. Traditionally, such market sentiment leads to the expansion of selling pressure, given that traders and institutions become more risk-averse.

But it also provides an opportunity to those who want to enter the market at the lowest point before Bitcoin touches critical support levels. The positive performance of many altcoins points to the possibility of more returns. However, it is still possible to find opportunities for trading in the current volatile market environment.