- Bitcoin tops $91K, signaling bullish momentum amid mixed crypto market trends.

- Market cap dips to $3.24T; Bitcoin dominance climbs to 56.08%, signaling investor focus.

- Smaller altcoins soar, with JUNO up 214.6% while major coins stay in the red zone.

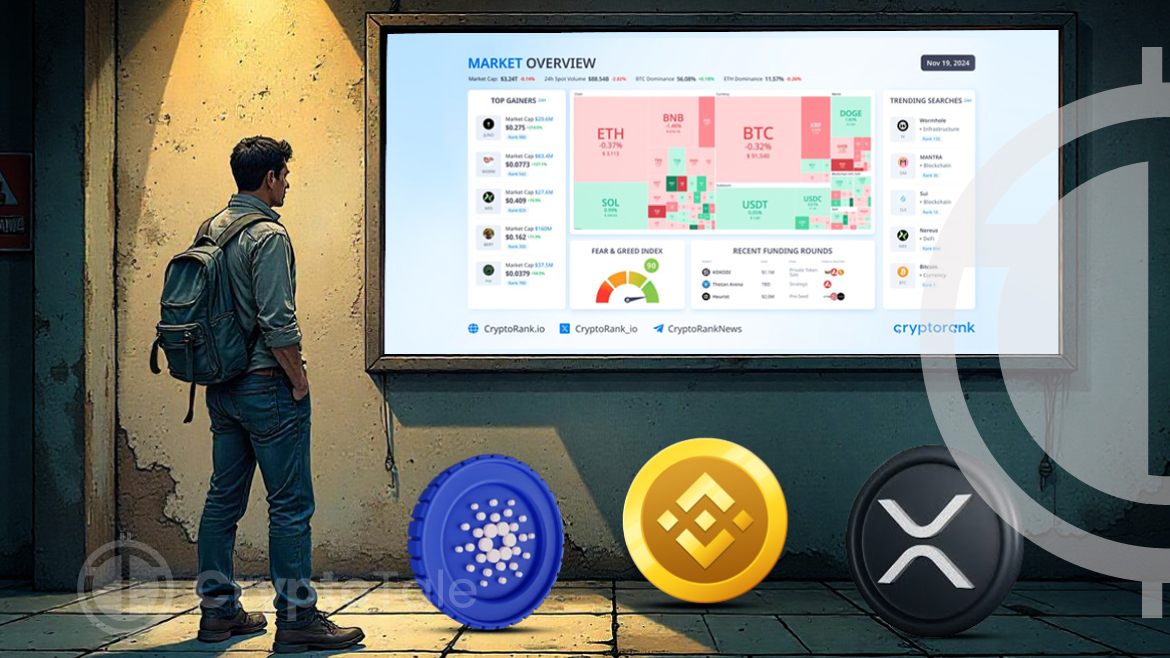

Analytical platform CryptoRank has shared their insights into the latest movements in the cryptocurrency market. In an X post on Monday, the platform noted that Bitcoin has traded at over $91,000, pointing to a bullish trend. With the increase in the price of Bitcoin, other major cryptocurrencies follow mixed performance.

According to platform findings, market capitalization has slightly reduced to $3.24 trillion, a 0.14% decline. Concurrently, BTC’s dominance has gone up to 56.08%, which means that investors are paying more attention to the largest cryptocurrency.

Market Sentiment Shows Greed

Overall, the sentiment remains positive, which was the same as last week. The Fear & Greed Index has been at 90, that is, the level is now at “Extreme Greed.” This means that more investors are coming in and willing to put their money at a present higher price multiple.

However, the top ten cryptocurrencies are trading with mixed results, with a majority of the coins in the red zone. XRP has fallen by 5.42%, ADA too has lost 3.32%, and BNB is down by 1.48%. This comes when market volatility has remained high even with the biggest cryptocurrency, Bitcoin, recording a phenomenal increase.

Top Performing Altcoins

Although the majority of the market is either stagnant or in decline, certain small cryptocurrencies have delivered impressive gains. These are led by JUNO which has skyrocketed by 214.6%.

Bitcoin Targets $138K as Historical Patterns Signal GrowthDeep Worm (WORM) was also significant with a 127.1% surge while Nereus (NRS) also soared with a 74.9% rise. Other coins such as Bertram The Pomeranian (BERT) and Bop Cat (BOP) also rallied significantly to increase by 71.9% and 54.5%, respectively.

The recent upward trend of Bitcoin prices above $91,000 strengthens its position in the crypto market. However, the fluctuations of other major cryptocurrencies and the current instability of the market are indicators of the problems that can arise. As markets develop, it is crucial that entities continue to make strategic decisions to enable them to leap onto the right opportunities.