- Bitcoin recently smashed through the $26,030 resistance level, aiming for $27,000 next.

- Technical indicators signal neutral to bearish momentum in the near term.

- Bears might seize control again, targeting a fall back to $25,300 levels.

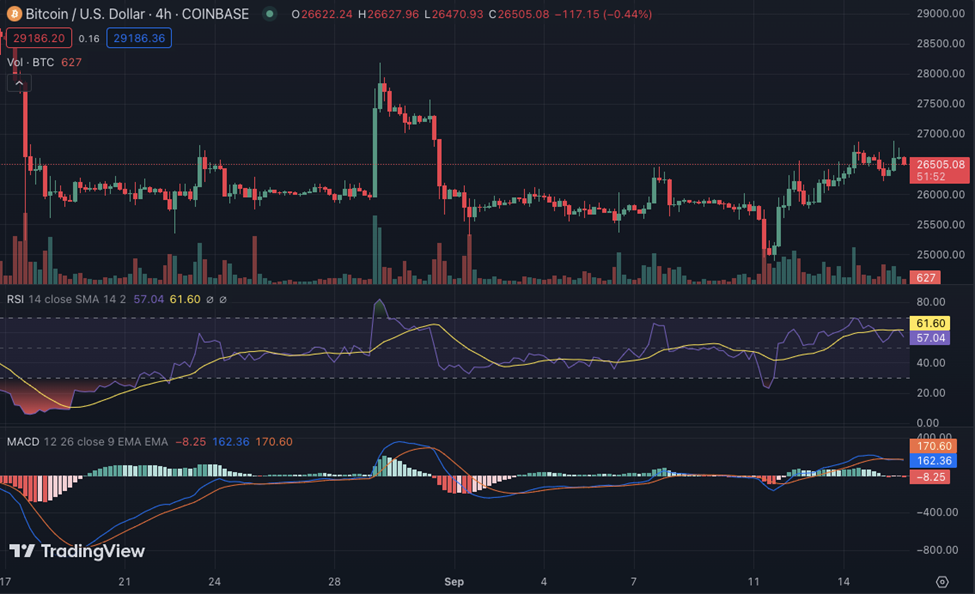

In a noteworthy development today, Bitcoin surged past the pivotal $26,030 mark. For the past week, the digital currency had been oscillating below the $26,000 level. However, it now appears to have entered a bullish phase, trading at around $26,496 at the time of this report. A bullish divergence marked the beginning of this price climb, setting the stage for Bitcoin’s current upward trajectory.

Crypto analysts and educators known on Twitter as CryptoBusy shared a post providing insights on the current valuable trends of the Bitcoin market:

#Bitcoin Short and Rebound Play! ✅

— CryptoBusy (@CryptoBusy) September 12, 2023

• Price broke below the $25,300 support, shorted it, and took profit.

• Then the price created a bullish divergence, setting up for a rebound play, rode the trend, and took profit! (Long)

We've been sharing this insights to our community,… pic.twitter.com/2G6MY8JtuF

The currency touched an intraday high of $26,830, nearing its newly established resistance level at $26,800. The next significant resistance is placed at the $27,000 mark for traders eyeing a good entry or exit point. If the present bullish momentum sustains, this could be the next target for Bitcoin investors. Nevertheless, if Bears makes a come back the cryptocurrency is likely to retake the market, pushing the price back toward the $25,300 support zone.

Over the past seven days, bullish sentiments have dominated the Bitcoin market. Despite short-lived bearish corrections, the price of Bitcoin has risen by more than 2.50% in one week. Market enthusiasts seem to be increasingly optimistic about cryptocurrency, given these upward movements.

At present, Bitcoin’s market capitalization sits at $516 billion, and its 24-hour trading volume amounts to $11.60 billion. On the downside, the currency’s intraday low stood at $26,240, a level that’s presently serving as a substantial support line. This could be crucial in the event of a bearish turnaround.

As for technical indicators, they mostly hover in the neutral zone. Specifically, the 20-day Exponential Moving Average (EMA) is above the 50-day EMA. This generally indicates a bullish momentum but must be interpreted cautiously due to other contradicting signals. For instance, the Moving Average Convergence/Divergence (MACD) is currently in negative territory, hinting at bearish momentum for the cryptocurrency. Moreover, the signal line of the MACD is also below the zero line, underscoring the bearish undertone. The Relative Strength Index (RSI) is positioned at 57, further confirming the market’s neutral standing.

To sum up, Bitcoin has shown promising bullish activity, breaking through key resistance levels. Yet, traders should remain vigilant due to some bearish signals and the possibility of a downward correction. The next few trading sessions will be pivotal in determining whether Bitcoin can sustain this uptrend or if the bears would reclaim the territory.