- Bitcoin’s price surpasses past cycles, signaling strong market confidence ahead of potential ETF approval and April’s halving event.

- Resistance at $38,000 is pivotal for Bitcoin’s next move; breaking it could lead to $40,000, while failure risks a drop to $35,000.

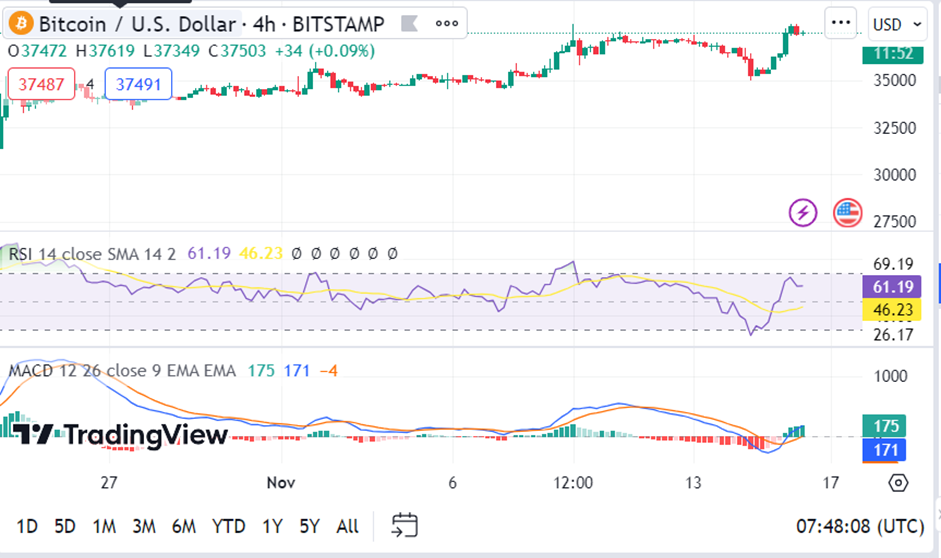

- Bitcoin’s technical indicators show a positive trend but caution needed, as RSI and MACD hint at potential short-term overbought status.

As the Bitcoin landscape evolves, recent price movements and upcoming events are drawing significant attention. Currently, Bitcoin is trading at $37,611.10, marking a notable increase of 5.62% in just one day and 2.24% over the last week. The market capitalization of this cryptocurrency has impressively soared to $735 billion. Concurrently, its trading volume has also escalated, hitting $28.8 billion in the same timeframe.

As highlighted by Layergg, a prominent blockchain analytics platform, Bitcoin’s current market performance is exceeding its past two cycles, demonstrating strong momentum. With the potential ETF approval in the next two months and the halving event 152 days away, a significant pivot began on November 21.

Notably, Bitcoin’s recent price action has outperformed the last two cycles, hinting at a robust market sentiment. According to Altcoin Sherpa, a prominent figure in crypto, the critical resistance at $38,000 is the current focus. A strong break above this level could propel Bitcoin past $40,000. Conversely, failure to overcome this barrier might see a retraction to around $35,000.

As the halving approaches, companies in the Bitcoin ecosystem face a crucial phase. This event historically triggers market shifts due to the halving of mining rewards. While it brings opportunities, businesses must balance short-term market dynamics with long-term strategy. Over-reliance on short-term gains could lead to strategic missteps, jeopardizing future sustainability.

Technical indicators provide further insight. The 4-hour Relative Strength Index (RSI) of 61.19 suggests a slightly overbought condition, cautioning against immediate bullish expectations.

Meanwhile, the 50, 100, and 200-day Exponential Moving Averages (EMAs) at 36,417, 35,574, and 33,774, respectively indicate a positive trend, with strong support around the 100 EMA. This bullish momentum is further supported by the 4-hour Moving Average Convergence Divergence (MACD) reading of 171, although it’s nearing overbought territory.

Bitcoin’s current trajectory is marked by optimism, tempered by the need for cautious strategic planning. As the ETF decision and halving draw near, market dynamics are likely to intensify. Investors and businesses alike should monitor these developments closely, balancing the potential for short-term gains with the imperative for long-term viability.