- Bitcoin whales show diminishing accumulation during dips, signaling conviction in the crypto market.

- According to Clark Moody’s Bitcoin dashboard, Bitcoin has completed its one billionth transaction.

- Technical indicators like RSI and MACD provide insights for traders navigating Bitcoin’s price fluctuations.

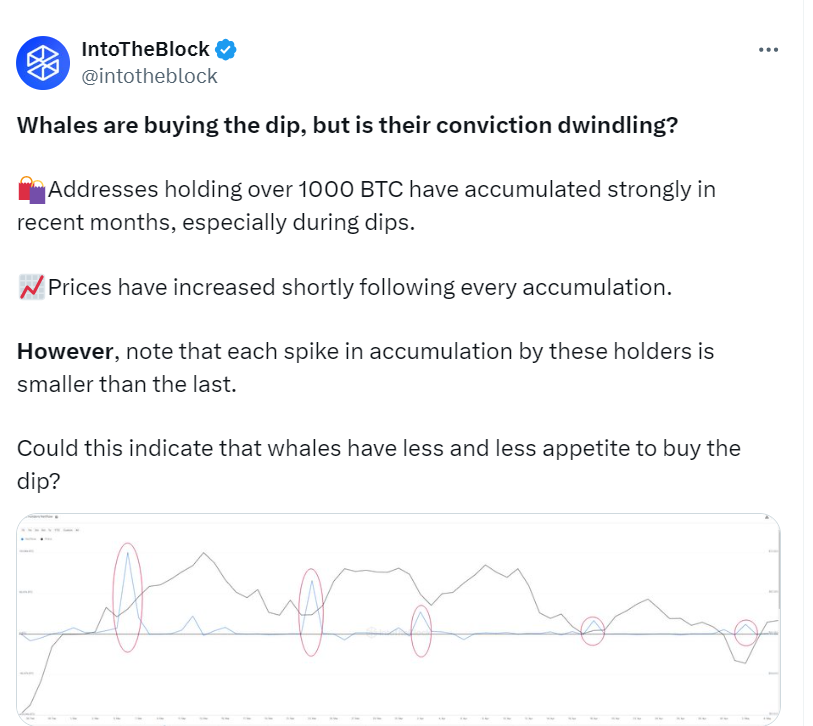

Bitcoin whales possessing large quantities of Bitcoin appear to be accumulating amid market downturns, according to IntoTheBlock. The X post by IntoTheBlock suggests a noteworthy trend. While major holders are buying the dip, their conviction might be waning.

In recent months, addresses possessing over 1000 BTC have consistently accumulated more assets, particularly during market dips. Each instance of accumulation has been followed by a subsequent price increase. However, there’s a crucial detail to note. With each spike in accumulation, the increment appears to be diminishing compared to the previous scenario. It indicates a potential decline in whales’ appetite for buying the dip.

At the time press, the Bitcoin rate was $63,248, and the 24-hour trading volume exceeded $30 billion. Nonetheless, a meager 0.96% drop in the last 24 hours has not changed the fact that Bitcoin holds the dominant position in the cryptocurrency market, with its market value standing at more than $1.25 trillion. The current supply of BTC circulating is close to 19.7 million, which almost equals the maximum limit of 21 million coins.

Analyzing Bitcoin’s technical indicators further, the Relative Strength Index (RSI) on the daily chart reads 55.32, signaling a neutral stance. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator suggests robust upward momentum, registering at 831. Traders can leverage these metrics to formulate informed strategies amidst market fluctuations.

Source: TradingView

Subsequently, the Bitcoin network recently marked its one billionth transaction, according to Clark Moody’s Bitcoin dashboard. The discussion surrounding Bitcoin transactions and associated fees has intensified, fueled partially by the introduction of Bitcoin Ordinals and Runes. Runes, the fungible token protocol introduced alongside the latest Bitcoin halving, set a new record for transaction fees during its launch.