The Bitcoin (BTC) bull market has faced some resistance this week, according to a report by cryptocurrency analytics firm Glassnode. The market reverted from a weekly high of over $31,000 to a low of $27,000, signaling a potential correction in the market.

Glassnode’s analysis showed that Bitcoin has had a strong start to 2023, despite a recent dip. However, there have been a few significant corrections during this period. The financial market recently experienced a correction of -18.6%, the largest correction. Nonetheless, compared to past cycles, this drawdown is relatively small.

Glassnode shared a tweet commenting on the severity of the BTC correction:

Assessing the severity of #Bitcoin Bull Market Corrections experienced across major cycles, our current maximum drawdown of 18.6% pales in comparison to historical precedence:

— glassnode (@glassnode) May 3, 2023

🟡2010: 49.4%

🔴2011: 71.2%

🔵2015: 36.0%

🟢2018: 62.6% pic.twitter.com/ZYpYy6sGJM

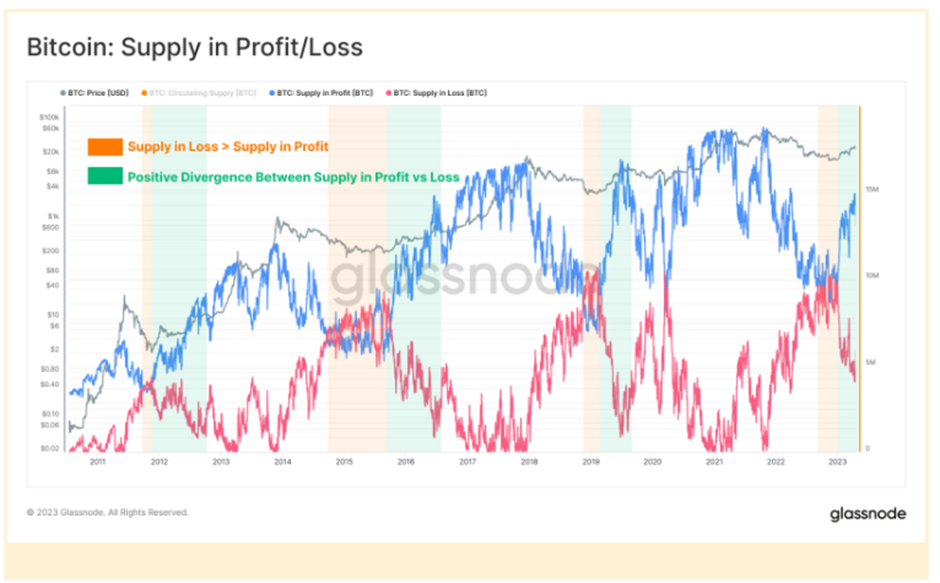

Glassnode claimed that the overall Bitcoin market has ended its unrealized loss phase and entered a time of unrealized profit. Supply retained at a profit differs greatly from supply held at a loss, indicating a bullish trend.

As this change occurs, the ratio of profitable to unprofitable supply reflects the increased incentive to take profits. This oscillator has reached escape velocity in 2023, according to Glassnode’s study, demonstrating the exit from a regime of loss dominance close to cycle lows. Only 415 out of 4,638 trading days, or just 9% of the time, have this phenomenon been noted.

This market change is crucial because it indicates that investors are growing more optimistic about Bitcoin’s long-term potential. As more investors enter an unrealized profit position, they might be more inclined to hold onto their investments than to sell at a profit and run the risk of missing out on future gains.