- Bitcoin’s recent shift to a red weekly candle prompts market scrutiny, with Altcoin Sherpa highlighting the end of an eight-week green streak.

- Despite the dip, some assert Bitcoin remains in a bull market, but indicators like RSI and MACD signal caution in the short term.

- Investors are urged to balance perspectives, considering dynamic market factors, as the recent change sparks discussions about Bitcoin’s immediate future.

The world of cryptocurrency is witnessing a notable shift as Bitcoin (BTC) recently closed its first weekly red candle as highlighted by Altcoin Sherpa an analyst after an impressive streak of eight consecutive green candles. This significant change has prompted market participants to scrutinize the current state of affairs and evaluate the implications for the broader crypto landscape.

At the press time, Bitcoin is priced at $41,165.83, reflecting a 1.91% decline in the past 24 hours and a 1.90% drop over the last seven days. The market cap stands at a staggering $805.75 billion, emphasizing the immense influence Bitcoin holds within the digital asset space.

The recent turn of events, marked by the first weekly red candle after a prolonged bullish run, has sparked discussions about the overall health of the Bitcoin market. Some traders and enthusiasts are quick to emphasize the need to zoom out and recognize the bigger picture – asserting that despite the recent dip, the overarching trend suggests that Bitcoin is still firmly in a bull market.

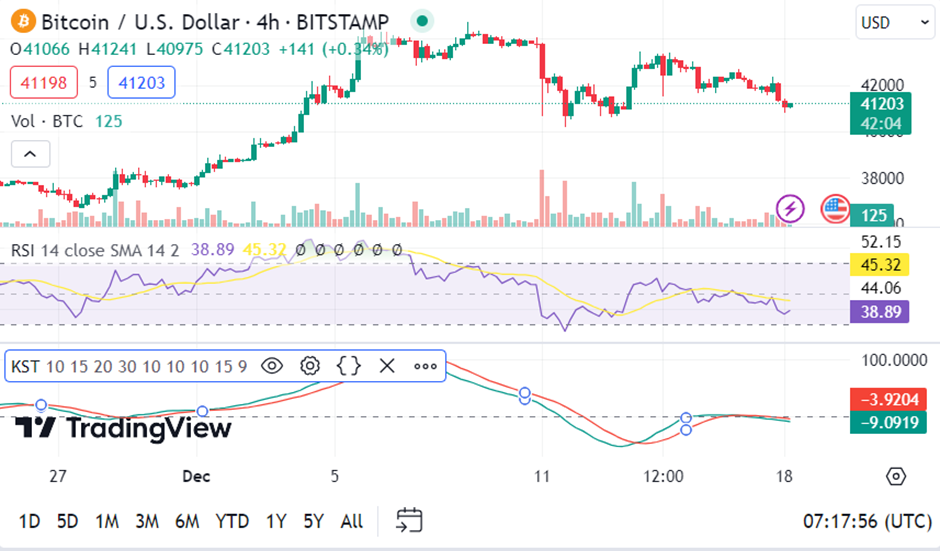

However, a closer look at key indicators reveals nuanced insights. The Bitcoin Relative Strength Index (RSI) currently stands at 38.89, indicating a potential approach to oversold territory. For traders, this could present an opportune moment to consider market entry, as historically, such RSI levels have hinted at impending price rebounds.

On the flip side, the 4-hour Moving Average Convergence Divergence (MACD) is sending a more cautionary signal with a reading of -273. This negative value suggests a short-term downward trend for Bitcoin, urging traders to exercise prudence in their decision-making processes.

Adding to the bearish sentiment is the 4-hour KST (Know Sure Thing) indicator, which records a low reading of -9.1495. This aligns with the MACD analysis, further emphasizing the need for vigilance in the current market conditions.

Besides these technical indicators, it is crucial to acknowledge the dynamic nature of the cryptocurrency market. Market sentiment can be influenced by a myriad of factors, including macroeconomic trends, regulatory developments, and institutional participation.

Hence, while the recent red candle may signal a potential shift in short-term sentiment, it is essential for investors to approach the situation with a balanced perspective. Consequently, maintaining a diversified portfolio and staying informed about broader market dynamics becomes significantly important in navigating the uncertainties within the cryptocurrency space.

The recent change in Bitcoin’s weekly candle color has ignited discussions about the immediate future of the cryptocurrency. Nevertheless, investors are reminded of the importance of a comprehensive analysis, considering various indicators and external factors, to make informed decisions in this ever-evolving market.