- Bitcoin’s recent price dip attracts whales, with a 4.50% rise in major holders, signaling strong long-term confidence in its value.

- Analyst shift to a long position as Bitcoin surpasses $43,000, reflecting market optimism and belief in sustained growth potential.

- Despite resistance, Bitcoin’s push past $43k highlights increasing buying pressure, indicating a bullish market trend and investor readiness for higher targets.

Bitcoin, the trailblazing cryptocurrency, has recently witnessed a significant shift in its investor landscape amidst a market correction. While the dip in Bitcoin prices caused apprehension among many, it presented a lucrative opportunity for large-scale investors, commonly called ‘whales.’ These entities have strategically increased their Bitcoin holdings, showcasing a strong confidence in the digital currency’s future.

In a remarkable two-week period, the Bitcoin ecosystem observed the emergence of approximately 67 new whale entities, each possessing over 1,000 BTC. This development marks an impressive 4.50% surge in major Bitcoin holders. The accumulation of Bitcoin by these whales during a period of price correction is a noteworthy trend, shedding light on their investment strategy and perspective on the cryptocurrency’s long-term value.

A detailed Twitter post by Ali, a renowned cryptocurrency analyst, brought this trend into the spotlight. Ali’s insights provided a deeper understanding of the current Bitcoin market dynamics. This movement by the whales is pivotal, illustrating a contrarian investment approach where market downturns are viewed as opportunities rather than setbacks.

The increase in whale activity is not just a mere statistic; it’s a strong signal to the market. These seasoned investors see potential growth and a rebound in Bitcoin’s value in the foreseeable future. Their actions speak to a broader sentiment among savvy investors that looking beyond short-term volatility and focusing on the long-term prospects of Bitcoin.

Bitcoin’s trajectory has caught the keen eye of a cryptocurrency analyst, especially as it soared past the critical $43,000 benchmark. Responding to this bullish momentum, the analyst has strategically shifted to a long position, signaling a strong belief in Bitcoin’s continued upward movement. This decision underscores a broader sentiment of optimism in the cryptocurrency market, particularly regarding Bitcoin’s potential for sustained growth.

The analyst’s move to go long at this juncture is a calculated response to Bitcoin’s performance, which has convincingly broken through a previously resistant price point. It’s a clear indication that market watchers are closely monitoring price trends and are ready to adjust their strategies in alignment with the perceived direction of the market.

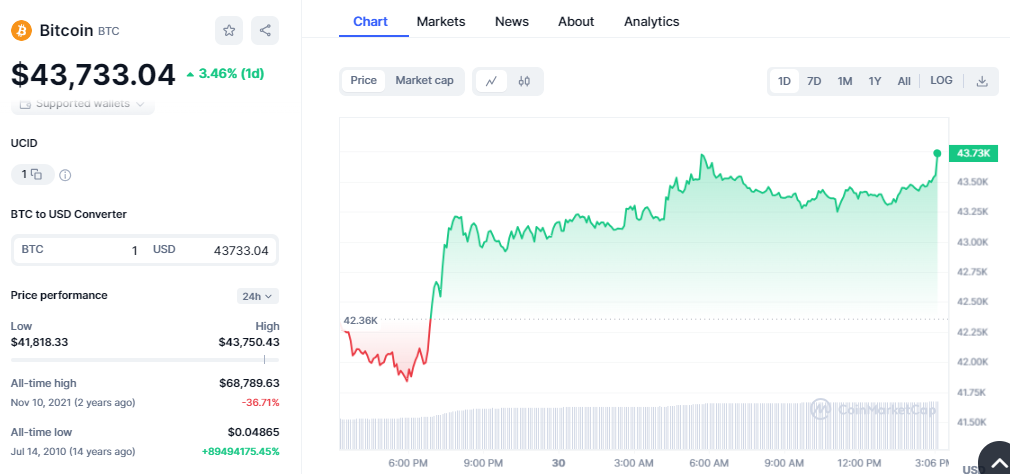

As of this writing, BTC is trading on a bullish outlook as bulls take the lead. BTC opened today’s session below $42k and climbed above the $43k level to face resistance at $43,750. Despite the resistance at this level, BTC is trading slightly below this level at $43,733 as the buying pressure mounts. The buyers push to break above this level to reach the previous highs at $48k.

This recent shift in strategy by the analyst is more than just a personal investment decision; it reflects a broader trend in the cryptocurrency world where thresholds like the $43,000 mark are not just numbers but signals that prompt significant action from investors and analysts alike. As Bitcoin continues its unpredictable journey, the actions and insights of seasoned market participants will remain invaluable for understanding the complex dynamics.