- A $25M OTC sale by a $BONK developer sparks market frenzy, raising questions about meme coin sustainability.

- Sharp price dip triggers breach of support levels, indicating heightened volatility and potential trend reversal.

- BONK investors rattled as the meme coin’s vulnerability was exposed, emphasizing the need for cautious market navigation.

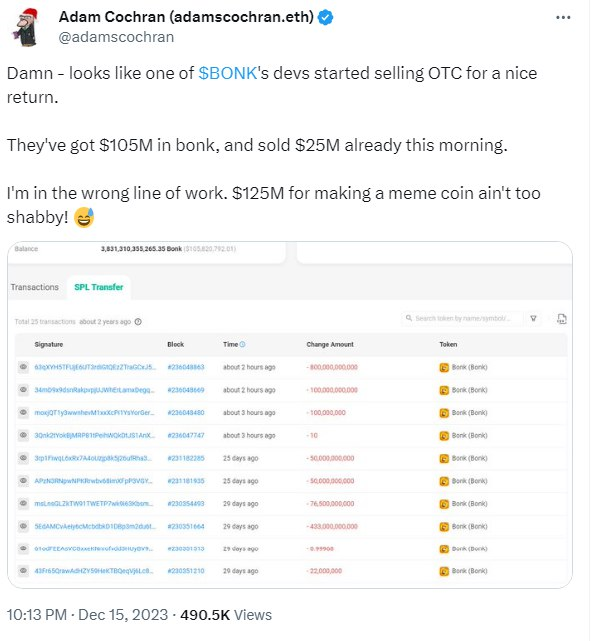

In a surprising turn of events, the crypto community was sent into a frenzy as news broke that one of the developers behind the meme coin sensation, $BONK, opted to cash in on their success. Adam Cochran, a seasoned crypto analyst, took to Twitter to share the jaw-dropping revelation. The developer reportedly offloaded a staggering $25 million worth of $BONK over-the-counter (OTC), adding up to a grand total of $125 million in sales, leaving many in awe of the substantial gains made in the world of meme coins.

$BONK, known for its playful and eccentric nature, had gained significant traction in recent times, attracting both enthusiasts and skeptics alike. With a sizable holding of $105 million in $BONK, the developer’s decision to liquidate a portion of their assets raises questions about the sustainability of meme coins and the potential impact on the broader crypto market. This move underscores the evolving dynamics within the crypto space, where unexpected twists could shape market sentiment and influence investor behavior.

As of the latest available data, $BONK is priced at $0.00002393. The current price reflects a 21.99% decline over the past 24 hours, despite the previous day’s substantial hike that marked a monthly high of more than 1000%. This substantial movement in price warrants a closer examination of the coin’s technical indicators to gauge potential market trends. $BONK’s market cap currently stands at $1.46 billion, ranking it at #51 in the cryptocurrency market. The 24-hour trading volume is an impressive $1.67 billion, securing its position at #8. The volume/market cap ratio stands at 42.35%, indicating robust market activity and liquidity.

Taking a closer look at the technical indicators, the sudden sell-off has caused a ripple effect on $BONK’s price action. The MACD indicator reveals a potential bearish divergence, signaling a shift in momentum. Traders should closely monitor this development as it may suggest a forthcoming correction in $BONK’s price. The RSI currently stands at 28.99%, indicating an oversold condition. While this might suggest a potential buying opportunity, investors should exercise caution, considering the recent sell-off and its implications on market sentiment.

Bollinger Bands indicate a period of heightened volatility, with price movements deviating from the average. This volatility may present both opportunities and risks for traders, emphasizing the need for careful analysis and risk management. Analyzing price and chart patterns is crucial in understanding $BONK’s market behavior.

In the aftermath of this sell-off, the $BONK community finds itself at a crossroads, grappling with the impact of a significant developer divestment. This incident prompts a reevaluation of the broader meme coin landscape, forcing participants to consider the long-term viability of such projects.

In conclusion, the $BONK developer’s OTC sell-off serves as a stark reminder of the dynamic nature of the crypto market. The substantial gains made from a meme coin underscore the speculative nature of certain assets within the space. As the crypto market continues to mature, events like these shed light on the importance of due diligence and risk management in navigating the volatile and unpredictable nature of digital assets.