Bitcoin showed a dramatic price correction, falling from its historic high of $103,583.91 to a low of $91,998.78, as multiple factors contributed to a major market adjustment. The cryptocurrency market witnessed massive liquidations totaling over $4.8 billion, with short positions leading the long positions.

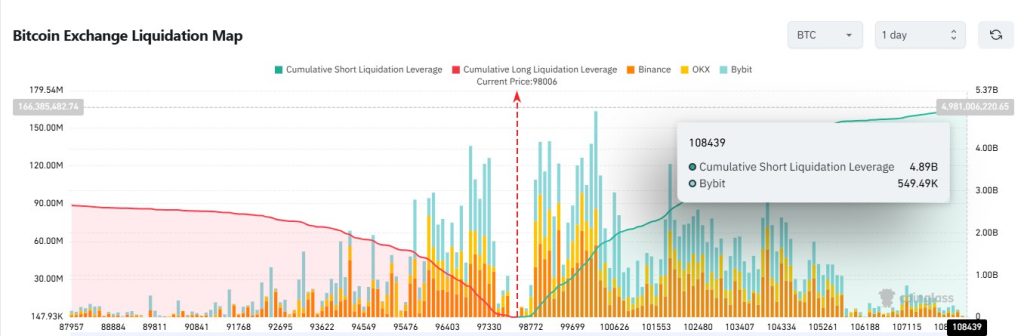

The exchange liquidation map reveals a substantial cumulative short liquidation leverage of $4.8B. This selling pressure was seen across major exchanges, with the impact particularly visible in the trading volumes and liquidation patterns of leading platforms. A detailed breakdown of the 24-hour liquidation data shows total market liquidations reaching $894.28 million.

OKX emerged as the leading exchange in terms of liquidation volume, processing $281.12 million worth of liquidations. This represents 57.72% of the total market activity. Binance followed with $69.51 million (14.27%), and Bybit recorded $43.74 million (8.98%) in liquidations.

Paul Atkins to Lead SEC: A New Era for Crypto RegulationSeveral key factors have influenced this market correction. Long-term holders who acquired Bitcoin at lower prices, ranging from $16,000 to $23,000, appear to be taking profits, creating substantial selling pressure. The psychological barrier of $100,000 has also played a crucial role. This triggered profit-taking behavior among traders who had anticipated this milestone.

The distribution of liquidations across exchanges provides deeper insight into market dynamics. OKX processed $270.19 million in long liquidations and $10.94 million in shorts. On the other hand, Binance handled $47.13 million in longs and $22.38 million in shorts. Bybit saw $31.77 million in long liquidations against $11.97M million in shorts. Smaller exchanges, including Bitfinex, HTX, and CoinEx, also experienced liquidation events, though at lower volumes.

Despite the current correction, market analysts suggest the possibility of Bitcoin establishing new all-time highs. When BTC hit the $100,000 milestone, meme coin analyst Murad predicted that $200,000 would be the next milestone for BTC.

The liquidation data indicates a healthy market reset, potentially setting the stage for continued upward momentum. The current price action, while volatile, reflects normal market behavior following the breach of a major milestone for BTC.