- Cardano (ADA) witnessed a surge in $100,000+ transactions, hinting at institutional interest and potential price shifts.

- Analyst Ali’s spotlight on increased ADA engagement underscores shifting ownership dynamics and significant crypto player involvement.

- The sustained high-value transactions align with Cardano’s innovation, attracting institutional attention amidst market correlations with crypto value spikes.

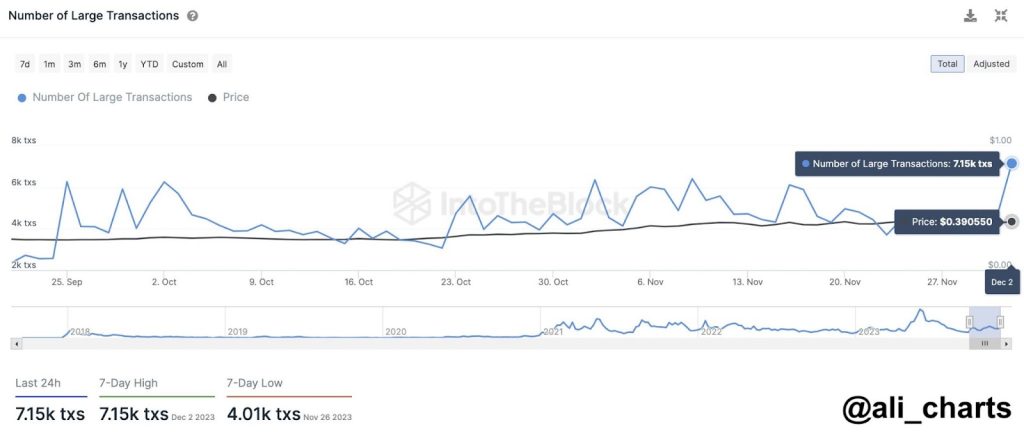

In a pivotal move, Cardano (ADA) has witnessed a substantial surge in transactions exceeding $100,000, consistently reaching new peaks. This surge in high-value transactions indicates a heightened interest in ADA from institutional players and major holders, often a precursor of potential price surges.

The surge in ADA transactions beyond the $100,000 threshold has been a notable trend, drawing attention within the cryptocurrency community. This surge, highlighted by a post from prominent crypto analyst Ali on the X platform, underscores the significant uptick in ADA transactions, hinting at increased engagement from influential entities in the crypto space.

The increase in these sizable ADA transactions suggests a notable shift in ADA ownership dynamics and usage patterns. Typically, such escalated activity involving substantial sums of money signifies the involvement of institutional investors and sizeable holders. Historically, this behavior has often served as an early indicator preceding considerable movements in the cryptocurrency’s value.

Cardano’s reputation for pioneering technology and scalability solutions in the blockchain domain attracts interest from significant investors looking for exposure to promising digital assets. The sustained surge in high-value ADA transactions aligns with the ongoing advancements and developments within the Cardano ecosystem, further enhancing its appeal to institutional players.

Source: Image by Ali

Cardano is trading at $0.4134, marking a rise of 4.63% in the last 24 hours and a 7.87% increase over the past 7 days. The 24-hour trading volume is $408,436,100, with a circulating supply of 35 billion ADA.

Observers and industry experts frequently draw connections between escalated institutional interest and subsequent surges in cryptocurrency prices. Past market trends have consistently shown a correlation between heightened institutional participation and subsequent appreciations in asset valuations.

As Cardano cements its position as a leading blockchain platform, the recent surge in large-scale transactions potentially signifies a broader trend of amplified institutional interest in this cryptocurrency. This trend might lay the groundwork for substantial price movements in the cryptocurrency’s value in the foreseeable future.