- Cardano’s $19 billion valuation raises doubts in the community due to a lack of meaningful use and utility.

- The absence of major stablecoins and meager Cardano-collateralized stablecoins highlight concerns about the network’s activity.

- ADA’s stagnant market performance amid a favorable crypto market raises doubts about its sustainability.

Questions arise about the tangible contributions of Cardano within the blockchain ecosystem, despite its market capitalization of $19 billion. Reportedly, Cardano finds itself under scrutiny for the apparent lack of meaningful use for its native token. K33 Research published a report “Why you should sell all your ADA (Cardano)” stating that the Cardano network’s lack of meaningful activity will eventually make it meaningless over time.

Recent assessments of Cardano’s network reveal a shocking reality – there’s a notable absence of proof regarding its practical applications. Supporters of the token might point to the roughly 90,000 daily transactions as a valid point, but a closer examination raises doubts about the depth of these transactions. In a space where blockchain activity is often equated with meaningful transactions, the doubts surrounding Cardano are more.

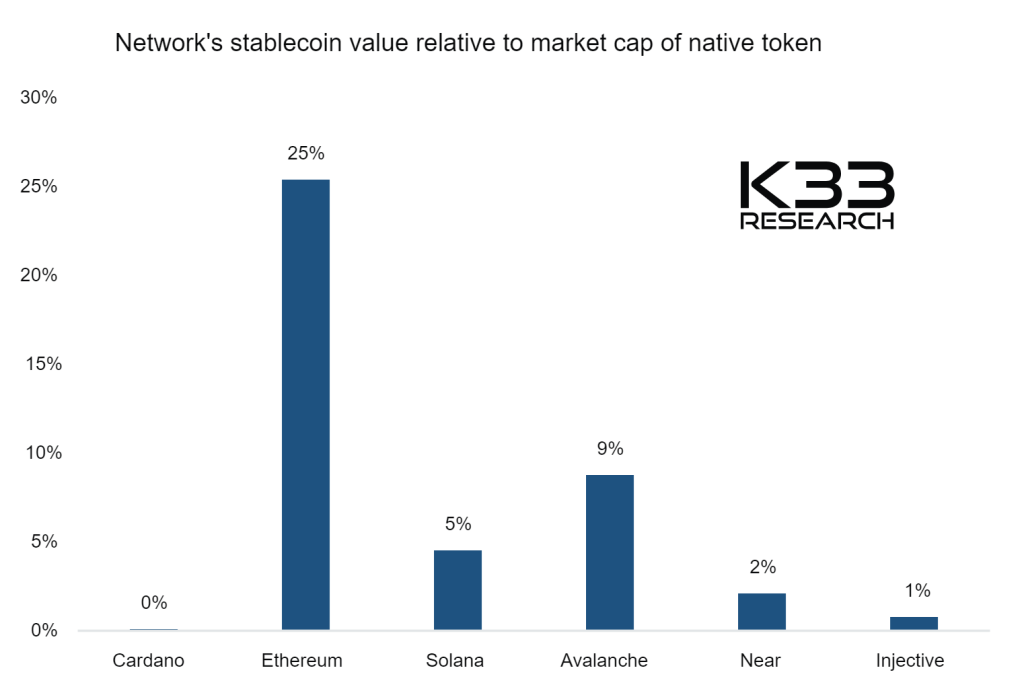

One of the main indicators of the network’s perceived inactivity lies in the stablecoin market. In the realm of decentralized finance (DeFi) altcoin trading, stablecoins like USDT and USDC play a crucial role. However, Cardano stands out by lacking any presence of these widely accepted stablecoins. Instead, the network features Cardano-collateralized stablecoins, numbering 20 million, but with a value pegged at a mere 76 cents to the dollar.

The absence of substantial traction over the years raises questions about Cardano’s prospects. Historically, projects with a prolonged lack of meaningful use and optimistic promises following upgrades or partnerships tend to fade into obscurity. Cardano’s current valuation of $19 billion raises eyebrows, especially considering its gradual disappearance from the crypto market’s limelight.

While ADA, Cardano’s native token, remains tradeable across various exchanges, including smaller local platforms, its market behavior tells a different story. Unlike other smart contract tokens that rally with market improvements, ADA’s stagnant performance signals concerns about its sustainability. The lack of a rally or a bull run even amid favorable market conditions, suggests a gradual decline rather than a swift demise.

Analysis shows Cardano’s market consolidation until April could lead to a potential bull run. ADA’s balanced RSI and neutral MACD indicate stable market conditions, but the future trajectory could be impacted by volatility and external factors.